MAXE Financial Markets Consulting: US Economic Calendar

FRIDAY, OCT. 18

8:30 am Housing starts

8:30 am Building permits

12:10 pm Federal Reserve Governor Christopher Waller speaks

10:00 am Home builder confidence index

Diversifying Your Portfolio: Noteworthy Country Bonds for December 2024:

As we approach December 2024, investors are increasingly looking beyond U.S. Treasury bonds to diversify their portfolios and seek opportunities in global fixed-income markets. This article examines several countries’ bonds that may warrant attention, evaluating their economic fundamentals, interest rate environments, geopolitical risks, and overall investment potential.

The Global Bond Market Landscape

The global bond market is vast and varied, with government bonds serving as a critical component. While U.S. Treasuries are often considered the benchmark for safety and liquidity, several other countries offer attractive alternatives for fixed-income investors. Factors such as yield differentials, economic stability, and currency strength play a significant role in determining the attractiveness of these bonds.

Key Countries to Watch

-

Germany

As Europe’s largest economy, Germany is known for its stability and robust industrial base. German bunds (government bonds) are considered a safe-haven investment, particularly in times of economic uncertainty.

Economic Outlook: With the European Central Bank (ECB) navigating inflationary pressures, the yield environment in Germany may remain relatively low but stable. Investors should monitor ECB policy decisions closely, especially any hints of interest rate changes that could affect bund yields.

Geopolitical Considerations: Germany’s role in the EU and its response to geopolitical tensions, such as those involving Russia and broader European stability, could influence investor sentiment. A strong euro against a weak dollar may also enhance the attractiveness of German bonds to U.S. investors.

-

Japan

Low interest rates and a unique monetary policy approach have long characterized Japan. Despite persistent economic challenges, Japanese government bonds (JGBs) remain a cornerstone of the global bond market.

Yield Dynamics: As of late 2024, the Bank of Japan (BoJ) may be contemplating adjustments to its longstanding negative interest rate policy. Any shift toward normalization could lead to increased yields on JGBs, making them more appealing to investors seeking income.

Risk Factors: Japan’s aging population and slow growth could pose long-term challenges. However, the country’s strong credit rating and commitment to fiscal discipline make JGBs a solid investment for conservative portfolios.

-

Brazil

Brazil offers a compelling case for investors looking for higher yields. Brazilian government bonds (Tesouro Direto) have drawn interest due to their attractive yield relative to developed markets.

Economic Recovery: Brazil is on a path of economic recovery, bolstered by commodity exports. As global demand for resources like soybeans and iron ore remains strong, Brazilian bonds may benefit from improved fiscal health.

Political Climate: Political stability remains a concern in Brazil, particularly with upcoming elections in late 2024. Investors should assess the implications of political changes on fiscal policy and economic reform, as these factors directly impact bond performance.

-

South Africa

South African government bonds (SAGBs) present another opportunity for yield-seeking investors, especially in a diversified portfolio.

Yield and Risk: SAGBs offer higher yields than other emerging markets, but they come with heightened risk due to structural economic challenges and political uncertainty. The South African Reserve Bank’s (SARB) approach to inflation management will be crucial in determining the direction of interest rates and bond yields.

Geopolitical Context: Ongoing social and economic issues, including high unemployment and political instability, may impact investor confidence. However, a potential recovery in commodity prices could support the economy and bolster bond attractiveness.

-

India

India is one of the fastest-growing major economies, and its government bonds (G-secs) have gained traction among international investors.

Growth Prospects: India’s demographic advantages and structural reforms present significant potential for economic growth. As inflation stabilizes and the Reserve Bank of India (RBI) manages interest rates effectively, G-secs may offer appealing yields.

Investment Climate: Foreign investment regulations have been liberalized, making Indian bonds more accessible to global investors. However, geopolitical tensions in the region, particularly regarding border disputes, could pose risks.

Comparative Analysis

When evaluating these countries’ bonds, several factors should be considered:

Yield vs. Risk: Higher yields often come with increased risk. Investors must weigh the potential returns against the geopolitical and economic risks inherent in each country.

Currency Exposure: Currency fluctuations can significantly affect returns on foreign bonds. A strong local currency enhances returns for foreign investors, while a depreciating currency can erode gains.

Economic Indicators: Monitoring key economic indicators such as GDP growth, inflation rates, and employment figures is crucial for assessing bond market health.

Conclusion

As December 2024 approaches, global investors should not overlook the opportunities presented by country bonds outside the United States. Countries like Germany, Japan, Brazil, South Africa, and India each offer unique investment cases based on their economic fundamentals, interest rate environments, and geopolitical landscapes.

Diversification into these markets can mitigate risks associated with U.S. Treasury bonds while potentially enhancing yield. However, thorough analysis and ongoing monitoring of global economic trends will be essential for making informed investment decisions in the evolving bond market landscape.

For investors willing to navigate the complexities of international bonds, December 2024 may present a compelling moment to explore these alternative investment avenues.

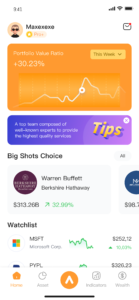

For more investment information, download our app: MAXE: The Revolutionary AI Financial Invest Management App. Get real-time updates on US stocks, securities, futures, exchange rates, and other asset information to help you make faster investment decisions.

MAXE serves users worldwide. As of now, the cumulative number of users who have downloaded the MAXE app has exceeded 300,000. This milestone indicates that an ever-growing number of individuals recognize the value of MAXE and are utilizing the app to optimize their investment and financial management strategies.

Now, MAXE is available on Google Play and App Store . Say goodbye to traditional financial management methods and embrace the future of finance with MAXE.