MAXE Financial Markets Consulting: US Economic Calendar

THURSDAY, NOV. 7

8:30 am Initial jobless claims Nov. 2

8:30 am U.S. productivity (prelim) Q3

10:00 am Wholesale inventories Sept.

2:00 pm FOMC interest-rate decision

2:30 pm Fed Chair Powell press conference

3:00 pm Consumer credit

December 2024 Dow Jones Stock Watchlist:

As we approach the end of 2024, investors are keenly focused on the Dow Jones Industrial Average (DJIA), a key indicator of the U.S. stock market’s health. With economic shifts, interest rate changes, and evolving market dynamics, certain stocks within the DJIA are emerging as particularly noteworthy for December. This article will explore several companies that are positioned for potential growth and the factors influencing their trajectories.

Economic Context

In 2024, the U.S. economy has navigated through a period of moderate growth, characterized by fluctuations in consumer spending and inflationary pressures. The Federal Reserve’s monetary policy has played a crucial role, with interest rates remaining relatively stable after a series of hikes in previous years. This environment has created both opportunities and challenges for investors, especially as companies begin to report their Q4 earnings and provide guidance for 2025.

Key Stocks to Watch

-

Apple Inc. (AAPL)

Apple remains a cornerstone of the DJIA, and its stock performance is often indicative of broader market trends. As the tech giant prepares to unveil its latest product lineup, including anticipated updates to the iPhone and new wearable technology, investor sentiment is cautiously optimistic. Analysts project that Apple’s services revenue will continue to grow, bolstered by its expanding ecosystem and subscription services.

-

UnitedHealth Group Incorporated (UNH)

In the healthcare sector, UnitedHealth Group stands out as a leader. The company has shown resilience amid regulatory changes and the ongoing evolution of the healthcare landscape. With an aging population and increasing demand for healthcare services, UnitedHealth’s diversified business model positions it well for sustained growth. Investors should pay attention to its upcoming earnings report, which is expected to highlight strong performance in its Optum segment.

-

Coca-Cola Company (KO)

Coca-Cola has consistently performed well, driven by its strong brand portfolio and global reach. The beverage giant is focusing on product innovation and sustainability initiatives, which resonate with modern consumers. In December, Coca-Cola is likely to report solid sales figures, aided by holiday promotions and a strong pipeline of new products. Analysts are optimistic about the company’s ability to navigate inflationary pressures while maintaining profitability.

-

Microsoft Corporation (MSFT)

As a leader in cloud computing and AI technology, Microsoft is poised for continued growth. The company’s Azure platform has seen significant adoption, and its investment in AI technologies is yielding positive results. With the digital transformation trend showing no signs of slowing, Microsoft is expected to report robust earnings in December, making it a stock to watch closely.

-

The Boeing Company (BA)

Boeing has been on a recovery path following the challenges posed by the pandemic and supply chain disruptions. As air travel demand rebounds, the company is ramping up production of its commercial aircraft. December could be a pivotal month for Boeing, as it may announce new orders and partnerships that could bolster investor confidence. The completion of key certifications for its 737 MAX and 787 Dreamliner models will also be critical in shaping its future outlook.

Market Sentiment and Trends

The sentiment around the DJIA stocks is influenced by various market trends. Investors are increasingly looking for companies with solid balance sheets and resilient business models. Sustainable practices and environmental, social, and governance (ESG) criteria are also becoming critical factors in investment decisions. Companies that prioritize these aspects are likely to gain favor among investors seeking long-term growth.

Additionally, the ongoing geopolitical tensions and their potential impact on global supply chains remain a concern. Investors will need to remain vigilant about how these factors may influence corporate earnings and stock performance in December and beyond.

Conclusion

As December 2024 approaches, the Dow Jones Industrial Average presents a mix of opportunities and challenges for investors. Companies like Apple, UnitedHealth Group, Coca-Cola, Microsoft, and Boeing are among those to watch closely, given their potential for growth and resilience in a fluctuating economic landscape. By staying informed about market trends and company performance, investors can make strategic decisions that align with their financial goals.

In this dynamic environment, thorough research and a keen understanding of macroeconomic factors will be essential for navigating the stock market successfully. As always, diversification and risk management should remain at the forefront of any investment strategy.

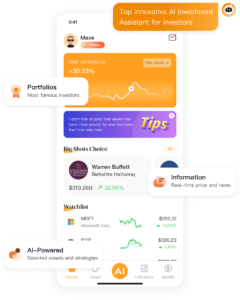

For more information on investment, download our app: MAXE: The Revolutionary AI Financial Invest Management App. Get real-time updates on US stocks, securities, futures, exchange rates, and other asset information to help you make faster investment decisions.

MAXE serves users around the globe. As of now, the cumulative number of users who have downloaded the MAXE app has exceeded 300,000. This milestone indicates that an ever-growing number of individuals recognize the value of MAXE and are utilizing the APP to optimize their investment and financial management strategies.

Now, MAXE is available on Google Play and App Store . Say goodbye to traditional financial management methods and embrace the future of finance with MAXE.