A medida que nos acercamos al año 2025, los inversores están interesados en identificar qué acciones de la Bolsa de Valores de Nueva York (NYSE) podrían ofrecer oportunidades de crecimiento significativas. La NYSE, sede de muchas de las empresas más grandes e influyentes del mundo, sigue siendo una plataforma fundamental para la inversión. Este artículo destaca varias acciones prometedoras y analiza los sectores a los que pertenecen, su potencial de crecimiento y los factores económicos más amplios que pueden influir en su rendimiento.

Panorama económico

El entorno económico mundial está experimentando cambios sustanciales, impulsados por los avances tecnológicos, los cambios en el comportamiento de los consumidores y la evolución de los marcos regulatorios. A medida que la economía se esfuerza por recuperarse de la pandemia de COVID-19, varios sectores están preparados para el crecimiento. La política monetaria de la Reserva Federal, las tasas de inflación y los acontecimientos geopolíticos también desempeñarán un papel fundamental en la configuración de la dinámica del mercado.

Sectores clave a tener en cuenta

-

Sector tecnológico

Corporación NVIDIA (NVDA) y Salesforce.com Inc. (CRM) son dos empresas destacadas en el sector tecnológico que los inversores deberían considerar.

-

Nvidia NVIDIA se ha posicionado como líder en unidades de procesamiento gráfico (GPU) y tecnología de inteligencia artificial (IA). A medida que la demanda de aplicaciones de IA sigue aumentando, es probable que las innovaciones de NVIDIA en aprendizaje automático y centros de datos impulsen un crecimiento sustancial de los ingresos. Las asociaciones estratégicas de la empresa y sus expansiones en nuevos mercados mejoran aún más su ventaja competitiva.

-

Fuerza de ventas, líder en software de gestión de relaciones con los clientes (CRM), está aprovechando la creciente necesidad de las empresas de mejorar la interacción con los clientes a través de herramientas digitales. Su enfoque en la integración de la IA, en particular con la plataforma Einstein, prepara el terreno para mejorar la eficiencia y la información sobre los clientes, lo que la convierte en una inversión atractiva en el panorama tecnológico.

-

Sector de la salud

Pfizer Inc. (PFE) y Grupo UnitedHealth Incorporated (UNH) son actores importantes en el sector de la salud y se espera que ambos tengan un buen desempeño en 2025.

-

PfizerPfizer, conocida por sus innovaciones farmacéuticas, ha ampliado su cartera más allá de las vacunas para incluir tratamientos para diversas enfermedades crónicas. El compromiso de la empresa con la investigación y el desarrollo, en particular en oncología y enfermedades raras, la posiciona bien para el crecimiento futuro. A medida que aumentan las demandas mundiales de atención médica, es probable que la diversa cartera de productos de Pfizer produzca resultados prometedores.

-

Grupo UnitedHealth, un actor importante en seguros de salud y servicios de atención médica, continúa creciendo a través de su división Optum, que se centra en servicios y tecnología de salud. A medida que el panorama de la atención médica cambia hacia una atención basada en el valor, el enfoque integrado de UnitedHealth lo convierte en un candidato sólido para el éxito sostenido.

-

Sector de energía renovable

El sector de las energías renovables está ganando impulso y empresas como NextEra Energy, Inc. (NEE) y Primera empresa solar, Inc. (FSLR) están a la vanguardia de esta transición.

-

Energía de NextEra, líder en producción de energía eólica y solar, está posicionada para beneficiarse del impulso global hacia la energía sustentable. Su amplia inversión en proyectos renovables y su compromiso con la reducción de las emisiones de carbono se alinean con las iniciativas gubernamentales, lo que la convierte en un actor vital en el mercado energético.

-

Primero Solar se especializa en tecnología solar y está preparada para crecer a medida que aumenta la demanda de soluciones de energía limpia. El enfoque de la empresa en la innovación y la eficiencia en la producción de paneles solares la coloca en una posición favorable a medida que más consumidores y empresas buscan fuentes de energía sostenibles.

-

Sector de consumo discrecional

Amazon.com Inc. (AMZN) y El Home Depot, Inc. (HD) Son dos gigantes del sector de consumo discrecional que merecen atención.

-

Amazonas Sigue dominando el panorama del comercio electrónico, y su expansión hacia la computación en la nube y la logística ha mejorado su trayectoria de crecimiento. El enfoque de la empresa en la experiencia del cliente y la innovación en los servicios de entrega la posicionan bien para captar una mayor participación de mercado a medida que evolucionan las preferencias de los consumidores.

-

El Home Depot Se ha beneficiado del aumento de proyectos de mejoras para el hogar, impulsado por las tendencias de trabajo remoto. Su sólida plataforma de comercio electrónico y su amplia gama de productos satisfacen tanto a los entusiastas del bricolaje como a los contratistas profesionales, lo que la convierte en una opción resistente en el sector de consumo.

-

Sector financiero

Visa Inc. (V) y JPMorgan Chase & Co. (JPM) Son acciones notables del sector financiero que los inversores deberían tener en cuenta.

-

Visa Visa es líder en pagos digitales y está bien posicionada para beneficiarse de la transición actual hacia transacciones sin efectivo. A medida que más consumidores adopten soluciones de pago móvil, la red y los avances tecnológicos de Visa probablemente impulsarán el crecimiento de los ingresos.

-

JPMorgan, uno de los bancos más grandes de Estados Unidos, tiene un modelo de negocio diversificado que incluye banca de inversión, gestión de activos y banca de consumo. A medida que aumentan las tasas de interés, se espera que JPMorgan vea mejores márgenes de interés neto, lo que mejorará su rentabilidad.

Tendencias e influencias del mercado

Es probable que varias tendencias del mercado afecten estas acciones:

-

Inflación y tasas de interés

Las tasas de inflación y la política monetaria de la Reserva Federal afectarán significativamente la confianza del mercado. El aumento de las tasas de interés podría afectar el gasto y el endeudamiento de los consumidores, lo que puede influir en las valoraciones de las acciones. Los inversores deberían permanecer atentos a los indicadores económicos y las comunicaciones de la Reserva Federal.

-

Avances tecnológicos

Los rápidos avances tecnológicos, en particular en materia de inteligencia artificial, computación en la nube y tecnologías de energía renovable, están transformando las industrias. Las empresas que aprovechen estas tecnologías de manera eficaz probablemente superarán a sus pares, lo que hace que las acciones tecnológicas sean particularmente atractivas.

-

Enfoque en la sostenibilidad

Las consideraciones ambientales, sociales y de gobernanza (ESG) influyen cada vez más en las decisiones de inversión. Las empresas que demuestran un compromiso con la sostenibilidad y la gobernanza responsable probablemente atraerán más inversiones, lo que afectará el rendimiento de sus acciones.

Conclusión

De cara al año 2025, la Bolsa de Nueva York ofrece una amplia variedad de oportunidades de inversión. Las acciones de los sectores de tecnología, atención sanitaria, energías renovables, consumo discrecional y finanzas se destacan como opciones prometedoras para los inversores. Al mantenerse informados sobre las tendencias del mercado y los indicadores económicos, los inversores pueden posicionarse estratégicamente para aprovechar las oportunidades de crecimiento en el dinámico panorama de la Bolsa de Nueva York.

En resumen, si bien el mercado de valores sigue siendo inherentemente impredecible, centrarse en empresas con fundamentos sólidos y potencial de crecimiento puede guiar a los inversores hacia una estrategia de inversión exitosa en 2025.

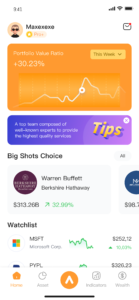

Para obtener más información sobre inversiones, descargue nuestra aplicación: MAXE: la revolucionaria aplicación de gestión de inversiones financieras con inteligencia artificial. Obtenga actualizaciones en tiempo real sobre acciones, valores, futuros, tipos de cambio y otra información sobre activos de EE. UU. para ayudarlo a tomar decisiones de inversión más rápidas.

MAXE presta servicios a usuarios de todo el mundo. Hasta el momento, el número acumulado de usuarios que han descargado la aplicación MAXE ha superado los 300.000. Este hito indica que un número cada vez mayor de personas reconocen el valor de MAXE y utilizan la aplicación para optimizar sus estrategias de inversión y gestión financiera.

Ahora, MAXE está disponible en Google Play y App Store . Diga adiós a los métodos tradicionales de gestión financiera y abrace el futuro de las finanzas con MAXE.