MAXE Financial Markets Consulting : Calendrier économique américain

Vendredi 15 novembre

8h30 Indice des prix à l'importation oct.

08h30 Indice des prix à l'importation moins le carburant Oct.

8h30 Enquête sur le secteur manufacturier de l'Empire State Nov.

8h30 Ventes au détail aux États-Unis en octobre.

8h30 Ventes au détail moins automobiles, octobre.

8h35 Entretien télévisé avec Austan Goolsbee, président de la Fed de Chicago

9h00 La présidente de la Fed de Boston, Susan Collins, prend la parole

9h15 Production industrielle Oct.

9h15 Utilisation des capacités en octobre.

10h00 Inventaires des entreprises Sept.

10h30 Entretien télévisé avec Susan Collins, présidente de la Fed de Boston

13h15 Allocution d'ouverture du président de la Fed de New York, John Williams

14h05 Entretien télévisé avec Austan Goolsbee, président de la Fed de Chicago

15h00 Entretien télévisé avec Tom Barkin, président de la Fed de Richmond

Les principales actions du secteur des nouvelles énergies à surveiller en décembre 2024 :

À l’approche de décembre 2024, le secteur des nouvelles énergies continue de prendre de l’ampleur, porté par des initiatives mondiales visant à réduire les émissions de carbone et à assurer la transition vers des sources d’énergie durables. Avec les progrès technologiques continus, les incitations gouvernementales et la demande croissante des consommateurs pour une énergie propre, les investisseurs s’intéressent de près aux actions de ce secteur en plein essor. Cet article se penche sur plusieurs acteurs clés du marché des nouvelles énergies qui sont sur le point de connaître une croissance significative et qui méritent une attention particulière ce mois-ci.

-

NextEra Energy, Inc. (NEE)

NextEra Energy reste l'un des plus grands fournisseurs d'énergie renouvelable au monde, se concentrant sur l'énergie éolienne et solaire. La société a régulièrement fait état d'une forte croissance de ses bénéfices et son engagement à élargir son portefeuille d'énergies renouvelables est évident dans ses récents investissements dans des projets solaires à travers les États-Unis. Les analystes prévoient que les bénéfices de NextEra continueront d'augmenter, en particulier grâce aux incitations fiscales fédérales pour les investissements dans les énergies renouvelables. Grâce à son infrastructure robuste et à ses acquisitions stratégiques, NextEra est bien placée pour mener la transition vers les énergies propres.

-

Enphase Energy, Inc. (ENPH)

Enphase Energy, leader dans le domaine des micro-onduleurs solaires, a connu une hausse remarquable du cours de ses actions au cours de l'année écoulée. Les produits innovants de la société améliorent l'efficacité des systèmes d'énergie solaire, les rendant plus attrayants pour les consommateurs. En outre, Enphase a étendu sa présence sur les marchés internationaux, notamment en Europe et en Australie, où la demande en énergie solaire est en plein essor. Alors que les installations solaires résidentielles se développent, l'accent mis par Enphase sur les solutions de gestion et de stockage de l'énergie la positionne comme un acteur clé dans le nouveau paysage énergétique.

-

Plug Power Inc. (PLUG)

Plug Power est à l'avant-garde de l'économie de l'hydrogène, spécialisée dans la technologie des piles à combustible. L'hydrogène étant de plus en plus utilisé comme source d'énergie propre, Plug Power est stratégiquement positionné pour profiter de cette évolution. L'entreprise a conclu de nombreux partenariats avec de grandes entreprises pour développer des infrastructures d'hydrogène, qui pourraient connaître une croissance substantielle dans les années à venir. Les investisseurs doivent surveiller les résultats trimestriels de Plug Power et les annonces de nouveaux contrats, car ils seront des indicateurs de ses performances futures dans le secteur de l'énergie.

-

Tesla, Inc. (TSLA)

Connue principalement pour ses véhicules électriques, Tesla est également un acteur important du secteur des énergies renouvelables grâce à ses produits solaires et de stockage d'énergie. Les projets ambitieux de l'entreprise visant à étendre sa division énergétique, associés au marché croissant des solutions de stockage d'énergie, en font une action à surveiller. La capacité de Tesla à innover et à intégrer sa technologie sur diverses plateformes renforcera probablement son avantage concurrentiel sur le marché des énergies renouvelables. Les investisseurs doivent garder un œil sur les prochains lancements de produits de Tesla et sur ses performances dans les solutions de stockage d'énergie, qui pourraient stimuler la croissance future.

-

First Solar, Inc. (FSLR)

First Solar est spécialisé dans la fabrication de panneaux solaires et la fourniture de centrales photovoltaïques à grande échelle. L'entreprise a récemment annoncé son intention d'augmenter sa capacité de production, répondant ainsi à la demande croissante d'énergie solaire dans le monde entier. En mettant l'accent sur la durabilité et la réduction de l'empreinte carbone de ses processus de fabrication, First Solar répond non seulement aux besoins du marché, mais s'aligne également sur les objectifs mondiaux de durabilité. Les analystes s'attendent à ce que l'action de First Solar bénéficie de l'adoption croissante de l'énergie solaire, en particulier aux États-Unis et dans les marchés émergents.

Tendances du marché et considérations d’investissement

À l’approche du mois de décembre 2024, plusieurs tendances façonnent le nouveau paysage énergétique. Le soutien continu de l’administration Biden aux initiatives en matière d’énergie propre, associé aux politiques nationales de promotion des énergies renouvelables, crée un environnement favorable à la croissance. En outre, les progrès réalisés dans les technologies de stockage des batteries et les infrastructures des véhicules électriques devraient stimuler davantage d’investissements dans les sources d’énergie renouvelables.

Les investisseurs doivent également être conscients des défis potentiels. Les changements réglementaires, les perturbations de la chaîne d’approvisionnement et la concurrence des sources d’énergie traditionnelles pourraient avoir un impact sur la rentabilité des actions du secteur des nouvelles énergies. Il est essentiel que les investisseurs effectuent une due diligence approfondie et prennent en compte le potentiel à long terme de ces entreprises dans le contexte de leurs stratégies opérationnelles et de leur positionnement sur le marché.

Conclusion

Le secteur des nouvelles énergies se trouve à un tournant décisif, avec de nombreuses opportunités de croissance à mesure que le monde évolue vers des solutions énergétiques durables. Des actions comme NextEra Energy, Enphase Energy, Plug Power, Tesla et First Solar sont sur le point de bénéficier de cette transition. À l’approche de décembre 2024, les investisseurs devraient garder ces entreprises sur leur radar, car elles représentent non seulement l’avenir de l’énergie, mais aussi le potentiel de rendements substantiels dans un marché en évolution rapide. En restant informés et engagés dans l’évolution du marché, les investisseurs peuvent se positionner pour capitaliser sur la révolution en cours dans le domaine des énergies propres.

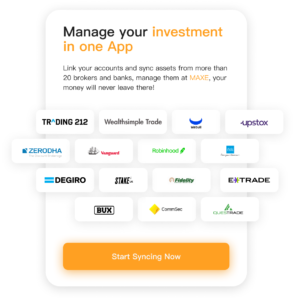

Pour plus d'informations sur les investissements, téléchargez notre application : MAXE : l'application révolutionnaire de gestion des investissements financiers basée sur l'IA. Obtenez des mises à jour en temps réel sur les actions américaines, les titres, les contrats à terme, les taux de change et d'autres informations sur les actifs pour vous aider à prendre des décisions d'investissement plus rapides.

MAXE dessert des utilisateurs du monde entier. À ce jour, le nombre cumulé d'utilisateurs ayant téléchargé l'application MAXE a dépassé les 300 000. Ce jalon indique qu'un nombre toujours croissant de personnes reconnaissent la valeur de MAXE et utilisent l'application pour optimiser leurs stratégies d'investissement et de gestion financière.

Maintenant, MAXE est disponible sur Google Play et App Store . Dites adieu aux méthodes traditionnelles de gestion financière et embrassez l’avenir de la finance avec MAXE.