À l’approche de 2025, les investisseurs se tournent de plus en plus vers les marchés boursiers étrangers, à la recherche d’opportunités au-delà de leurs places boursières nationales. Avec l’évolution de la dynamique économique mondiale, plusieurs marchés internationaux sont prêts à connaître une croissance, influencés par divers facteurs, notamment les avancées technologiques, les développements géopolitiques et l’évolution des comportements des consommateurs. Cet article explore les principaux marchés boursiers étrangers que les investisseurs devraient surveiller en 2025.

-

Les marchés asiatiques : un moteur de croissance

Chine

La Chine reste un pôle d’attraction pour les investisseurs internationaux en raison de son économie massive et de sa rapidité d’innovation technologique. En 2025, le marché chinois devrait bénéficier des initiatives gouvernementales visant à stimuler la consommation intérieure et à opérer la transition vers une économie plus durable. L’accent mis sur les technologies vertes et les énergies renouvelables devrait créer d’importantes opportunités pour les investisseurs dans des secteurs tels que les véhicules électriques, l’énergie solaire et la biotechnologie. En outre, l’assouplissement des pressions réglementaires sur les entreprises technologiques pourrait encore dynamiser le marché.

Inde

Le marché boursier indien est en hausse, porté par une croissance économique robuste et une population jeune. L'initiative « Make in India » du gouvernement indien devrait stimuler le développement de l'industrie manufacturière et des infrastructures, faisant du pays une destination attrayante pour les investissements étrangers. En 2025, des secteurs tels que les technologies de l'information, les produits pharmaceutiques et les biens de consommation devraient connaître une croissance substantielle. En outre, la numérisation croissante de l'économie offre de nouvelles opportunités aux startups technologiques et aux plateformes de commerce électronique.

-

Marchés européens : résilience face aux défis

Allemagne

L’Allemagne, première économie européenne, devrait jouer un rôle crucial dans la reprise économique du continent après la pandémie. Le marché allemand se caractérise par une base industrielle solide et une focalisation sur l’innovation. En 2025, les investisseurs devraient prêter attention à des secteurs tels que les énergies renouvelables, l’automobile et l’ingénierie. La transition vers une économie plus verte, associée à des investissements croissants dans les infrastructures numériques, positionne l’Allemagne comme un marché prometteur pour une croissance à long terme.

Royaume-Uni

Le marché britannique connaît des changements importants dans le cadre de son adaptation au contexte post-Brexit. Si des incertitudes subsistent, des opportunités émergent dans divers secteurs, notamment dans la fintech et les énergies renouvelables. La Bourse de Londres accueille un nombre croissant de startups technologiques et, à mesure que l'économie mondiale se numérise, ces entreprises sont susceptibles d'attirer des investissements considérables. L'engagement du Royaume-Uni à atteindre la neutralité carbone d'ici 2050 ouvre également des perspectives dans les technologies vertes et les investissements durables.

-

Marchés émergents : risques élevés, récompenses élevées

Brésil

Le Brésil, première économie d’Amérique latine, offre aux investisseurs un mélange de défis et d’opportunités. En 2025, le pays devrait tirer parti de ses vastes ressources naturelles et de son secteur agricole pour stimuler la croissance économique. Les investisseurs devraient se concentrer sur des secteurs tels que l’agroalimentaire, l’exploitation minière et les énergies renouvelables. Il est toutefois essentiel de rester prudent face à l’instabilité politique et à la volatilité économique qui peuvent avoir un impact sur les performances du marché.

Nigeria

Le Nigéria, première économie d'Afrique, présente un paysage d'investissement unique. Le pays est riche en ressources pétrolières et gazières, qui continuent de jouer un rôle essentiel dans son économie. Cependant, le marché nigérian se diversifie également, avec une croissance dans les domaines de la technologie et des télécommunications. En 2025, les investisseurs pourraient trouver des opportunités dans la fintech et le commerce électronique, car la pénétration croissante d'Internet et une population jeune favorisent l'adoption du numérique.

-

Innovation technologique : une tendance mondiale

Partout dans le monde, l’innovation technologique transforme les industries et crée de nouvelles opportunités d’investissement. Les marchés qui privilégient l’adoption des technologies et la transformation numérique sont susceptibles de surperformer. Les investisseurs doivent rechercher des entreprises qui exploitent l’intelligence artificielle, la blockchain et d’autres technologies de pointe pour améliorer l’efficacité et l’expérience client.

-

Considérations géopolitiques

Les facteurs géopolitiques influenceront sans aucun doute les marchés étrangers en 2025. Les relations commerciales, les changements réglementaires et les conflits internationaux peuvent créer à la fois des risques et des opportunités. Les investisseurs doivent rester vigilants et informés des évolutions politiques mondiales, car elles peuvent avoir un impact significatif sur les performances du marché.

Conclusion

À l’horizon 2025, les marchés boursiers étrangers offrent une multitude d’opportunités aux investisseurs en quête de diversification et de croissance. Les marchés d’Asie, d’Europe et des économies émergentes offrent chacun des avantages uniques, tirés par des facteurs tels que l’innovation technologique et les réformes économiques. Cependant, les récompenses potentielles s’accompagnent de risques inhérents, et les investisseurs doivent effectuer des recherches approfondies et tenir compte de leur tolérance au risque avant de prendre des décisions d’investissement. En surveillant de près ces marchés mondiaux, les investisseurs peuvent se positionner pour tirer parti des opportunités qui se présentent.

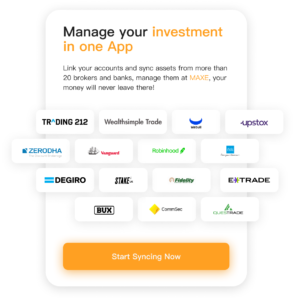

Pour plus d'informations sur les investissements, téléchargez notre application : MAXE : l'application révolutionnaire de gestion des investissements financiers basée sur l'IA. Obtenez des mises à jour en temps réel sur les actions américaines, les titres, les contrats à terme, les taux de change et d'autres informations sur les actifs pour vous aider à prendre des décisions d'investissement plus rapides.

MAXE dessert des utilisateurs du monde entier. À ce jour, le nombre cumulé d'utilisateurs ayant téléchargé l'application MAXE a dépassé les 300 000. Ce jalon indique qu'un nombre toujours croissant de personnes reconnaissent la valeur de MAXE et utilisent l'application pour optimiser leurs stratégies d'investissement et de gestion financière.

Maintenant, MAXE est disponible sur Google Play et App Store . Dites adieu aux méthodes traditionnelles de gestion financière et embrassez l’avenir de la finance avec MAXE.