12 décembre 2024 – L'indice composite Nasdaq a franchi pour la première fois la barre des 20 000 points, marquant ainsi une étape historique, en clôturant à 20 034,89 points après une hausse notable de 1,77%. L'indice a atteint un sommet intraday à 20 555,93 points, porté par des gains importants de grandes valeurs technologiques telles que Tesla et Alphabet, la société mère de Google.

L'action d'Alphabet a augmenté de 5,52%, terminant la journée à $195,40, avec une capitalisation boursière de $2,39 billions. L'action a atteint un pic intraday de $196,11, marquant un nouveau record historique. De même, l'action de Tesla a augmenté de 5,93% à $424,77, élevant la valeur boursière de la société à environ $1,36 billions, avec un sommet intraday de $424,88.

Depuis novembre, les gains continus des actions de Tesla ont considérablement augmenté la richesse du PDG Elon Musk, faisant de lui le premier milliardaire au monde avec une valeur nette dépassant 17400 milliards de TP.

D'autres géants de la technologie ont également connu des gains substantiels au cours de cette reprise boursière. L'action d'Amazon a augmenté de 2,32% pour atteindre $230,26, ce qui a donné lieu à une capitalisation boursière d'environ $2,42 billions. Dans le même temps, l'action de Meta a augmenté de 2,16% pour atteindre $632,68, avec une valeur de marché d'environ $1,60 billions.

Sur le plan macroéconomique, les données sur l'inflation du Département du Travail américain pour le mois de novembre, publiées avant l'ouverture des marchés, se sont rapprochées des attentes, ce qui a conduit les traders à renforcer leurs paris sur une éventuelle baisse des taux de la Réserve fédérale. L'outil FedWatch du CME indique une probabilité de plus de 90% d'une baisse de taux de 25 points de base mercredi prochain.

Tom Hainlin, stratège en investissement senior chez US Bank Asset Management, a déclaré : « Le marché est sur une tendance à la hausse et rien ne l'empêche de continuer à augmenter avant la fin de l'année. »

De plus, la Fédération nationale des entreprises indépendantes (NFIB) a signalé que l'indice de confiance des petites entreprises a augmenté de 8 points en novembre pour atteindre 101,7, le niveau le plus élevé depuis juin 2021. Les analystes suggèrent que les petites entreprises aux États-Unis ont une opinion favorable du président élu Trump, qui devrait arriver à New York mercredi soir et sonner la cloche d'ouverture à la Bourse de New York jeudi matin.

Selon certaines informations, Google est sur le point de connaître quatre jours consécutifs de hausse, après l'annonce faite il y a deux jours par la société du développement d'une puce puissante adaptée aux ordinateurs quantiques, qui a entraîné une hausse significative des actions technologiques dans leur ensemble. De nombreux initiés du secteur à Wall Street ont reçu des informations pertinentes sur cette tendance du marché plus tôt et ont ajusté leurs portefeuilles d'investissement en conséquence, ce qui s'est traduit par des bénéfices plus importants.

Mais comment les gens ordinaires peuvent-ils accéder à ces informations ? Acheter les mauvaises actions peut entraîner des pertes substantielles, même s’ils reçoivent des informations sur les secteurs susceptibles de progresser. Alors, comment les gens ordinaires peuvent-ils se référer aux stratégies des géants du monde des affaires pour ajuster leurs portefeuilles d’actifs ?

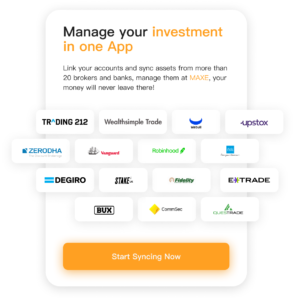

« Pour répondre à ces défis, MAXE, une application innovante de suivi des investissements, a pour vocation d’aider les investisseurs à trouver des portefeuilles d’actifs adaptés à leurs besoins », a déclaré le PDG de MAXE. « Nous offrons aux utilisateurs un accès direct aux portefeuilles d’investisseurs, de gestionnaires de fonds et de représentants gouvernementaux respectés. En suivant les changements en temps réel, nous permettons aux utilisateurs de naviguer en toute confiance dans les complexités du marché financier. Cette fonctionnalité élimine les obstacles à l’information qui entravent les investisseurs, en les tenant informés des évolutions du marché. En conséquence, les utilisateurs peuvent apporter des ajustements opportuns à leurs portefeuilles, en alignant leurs stratégies sur celles des leaders du secteur. »

MAXE offre aux investisseurs ordinaires une chance unique d'explorer les portefeuilles d'investissement de personnalités influentes, notamment des investisseurs de premier plan, des gestionnaires de fonds et des représentants du gouvernement. Cette fonctionnalité permet aux utilisateurs de suivre en temps réel les changements importants dans ces avoirs, les aidant ainsi à surmonter les obstacles importants à l'information que l'on trouve souvent sur les marchés financiers. En fournissant des informations actualisées, MAXE tient les utilisateurs informés de la dynamique du marché, leur permettant de prendre des décisions éclairées qui correspondent aux stratégies des leaders du secteur.

Pour aider les investisseurs qui risquent de manquer des opportunités clés en raison de retards dans la communication des informations, MAXE a lancé un assistant de gestion financière innovant basé sur l'IA. Cet outil avancé utilise le big data et un algorithme propriétaire pour recueillir les dernières informations financières auprès de sources fiables. Les utilisateurs peuvent interagir avec l'assistant en posant des questions sur leur situation financière et en recevant des stratégies d'investissement et de gestion financière personnalisées qui reflètent les tendances actuelles du marché et l'analyse des données. Cette approche personnalisée permet aux utilisateurs de naviguer plus efficacement sur le marché et d'améliorer leur prise de décision stratégique.

De plus, MAXE fournit des données de marché en temps réel sur divers actifs populaires, notamment les actions, les obligations, les matières premières et les devises. Les informations sont présentées sous forme de visualisations attrayantes qui simplifient les données complexes et les rendent plus faciles à comprendre. MAXE regroupe également des informations complètes sur les actifs qui intéressent les utilisateurs, tels que les mises à jour d'actualité, les développements financiers et les dépôts réglementaires. Cette compilation complète aide les utilisateurs à obtenir une vue complète des actifs qu'ils ont choisis, ce qui permet de prendre des décisions d'investissement éclairées.

L’immédiateté de ces fonctionnalités est particulièrement précieuse pour ceux qui souhaitent tirer parti des opportunités du marché. En analysant les stratégies des investisseurs à succès, les utilisateurs peuvent adopter des techniques et des modèles d’allocation efficaces, affinant ainsi leurs approches d’investissement. Ce processus d’apprentissage continu améliore non seulement leur compréhension des bonnes pratiques d’investissement, mais favorise également une culture de prise de décision éclairée. En fin de compte, MAXE fournit aux investisseurs ordinaires les outils nécessaires pour naviguer dans les complexités des marchés financiers avec plus de confiance et de clarté, les transformant en participants plus habiles dans le paysage de l’investissement.

MAXE dessert des utilisateurs dans le monde entier, avec plus de 300 000 téléchargements de l'application à ce jour. Ce jalon reflète une reconnaissance croissante de la valeur de MAXE, car de plus en plus de personnes se tournent vers l'application pour améliorer leurs stratégies d'investissement et de gestion financière.

MAXE est maintenant disponible sur Google Play et le App Store! Dites adieu aux méthodes traditionnelles de gestion financière et entrez dans l'avenir de la finance avec MAXE. Pour plus d'informations, visitez notre site Web à l'adresse www.maxeai.com et suivez-nous sur les réseaux sociaux pour les dernières mises à jour et conseils en matière de gestion financière.