As global economies continue to evolve, currency futures markets are becoming increasingly important for investors looking to hedge risks and capitalize on market movements. With 2025 on the horizon, several currency futures stand out due to their potential volatility, geopolitical influences, and economic indicators. This article explores the top currency futures to monitor in 2025, analyzing the factors that may affect their performance.

-

Euro (EUR/USD)

The Euro has long been one of the most traded currencies in the world, and its futures are closely watched by investors. In 2025, the Euro may experience significant volatility due to several factors, including the European Central Bank’s (ECB) monetary policy stance, inflation rates, and geopolitical tensions.

With inflation in the Eurozone remaining a critical concern, the ECB’s responses will be pivotal. If the ECB decides to tighten monetary policy, it could strengthen the Euro against the dollar. Conversely, if inflation persists, leading to a more dovish stance, the Euro could weaken. Additionally, the economic recovery post-pandemic and the impact of EU fiscal policies will be essential to monitor.

-

British Pound (GBP/USD)

The British Pound has faced numerous challenges in recent years, particularly following Brexit. As we look towards 2025, the GBP/USD futures will be influenced by the UK’s economic performance, trade agreements, and the Bank of England’s (BoE) interest rate decisions.

The ongoing adjustments in the UK’s trade relationships and economic policies will play a critical role in the Pound’s valuation. A potential recession could lead to a more accommodative monetary policy from the BoE, which would likely result in a weaker Pound. Conversely, strong economic indicators could bolster the currency. Monitoring key economic data releases, such as GDP growth and employment figures, will be crucial for investors.

-

Japanese Yen (USD/JPY)

The Japanese Yen is often viewed as a safe-haven currency, making its futures particularly interesting in times of global uncertainty. In 2025, the USD/JPY futures will be shaped by Japan’s economic recovery efforts, the Bank of Japan’s (BoJ) policies, and broader global market trends.

As Japan continues to tackle deflationary pressures, the BoJ’s approach to monetary policy will be significant. If the BoJ maintains its ultra-loose monetary policy while the Federal Reserve tightens, the Yen could depreciate against the Dollar. However, any signs of economic stability or growth in Japan could lead to a strengthening of the Yen, especially in a risk-off environment.

-

Swiss Franc (USD/CHF)

The Swiss Franc is another safe-haven currency, often sought after during periods of economic instability. In 2025, USD/CHF futures will be influenced by Switzerland’s economic health, the Swiss National Bank’s (SNB) interest rate decisions, and global risk sentiment.

The SNB has historically maintained a cautious monetary policy, and any shifts towards tightening could strengthen the Franc. Additionally, geopolitical developments in Europe and beyond will likely impact investor sentiment towards the Franc. Tracking global economic indicators and market volatility will be essential for those trading Swiss Franc futures.

-

Australian Dollar (AUD/USD)

The Australian Dollar is heavily influenced by commodity prices, particularly iron ore and gold, making its futures a reflection of global demand for these resources. In 2025, the AUD/USD futures will be shaped by Australia’s economic recovery, trade relationships, and the Reserve Bank of Australia’s (RBA) monetary policy.

With China being a significant trading partner, any changes in Chinese demand for commodities will directly impact the Australian economy and the value of the AUD. Furthermore, the RBA’s interest rate decisions in response to inflation and economic growth will be critical in determining the direction of the Australian Dollar.

-

Canadian Dollar (USD/CAD)

The Canadian Dollar is closely tied to oil prices, given Canada’s status as a major oil exporter. In 2025, USD/CAD futures will be influenced by the dynamics of the oil market, the Bank of Canada’s (BoC) policies, and economic indicators from both Canada and the United States.

If oil prices remain strong, the Canadian economy could benefit, leading to a stronger Loonie. However, any downturns in oil prices could weaken the currency. Additionally, the BoC’s response to inflation and economic growth will be essential for traders to consider.

निष्कर्ष

As we approach 2025, monitoring these currency futures will be crucial for investors looking to navigate the complexities of the global financial landscape. Each currency’s performance will be influenced by a myriad of factors, including central bank policies, geopolitical developments, and economic data. By staying informed and analyzing key indicators, traders can position themselves to capitalize on potential opportunities in the currency futures market.

In a world marked by uncertainty and rapid change, understanding the nuances of currency futures will be essential for making informed investment decisions. As always, diligent research and strategic planning will be critical for success in this dynamic market.

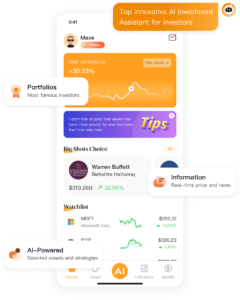

निवेश के बारे में अधिक जानकारी के लिए, हमारा ऐप डाउनलोड करें: MAXE: क्रांतिकारी AI वित्तीय निवेश प्रबंधन ऐप। अमेरिकी स्टॉक, प्रतिभूतियों, वायदा, विनिमय दरों और अन्य परिसंपत्ति जानकारी पर वास्तविक समय के अपडेट प्राप्त करें ताकि आप तेजी से निवेश निर्णय ले सकें।

MAXE दुनिया भर के उपयोगकर्ताओं को सेवा प्रदान करता है। अब तक, MAXE ऐप डाउनलोड करने वाले उपयोगकर्ताओं की संचयी संख्या 300,000 से अधिक हो गई है। यह मील का पत्थर दर्शाता है कि लगातार बढ़ती संख्या में लोग MAXE के मूल्य को पहचानते हैं और अपने निवेश और वित्तीय प्रबंधन रणनीतियों को अनुकूलित करने के लिए ऐप का उपयोग कर रहे हैं।