2025 年を見据えると、銀行セクターには投資家が慎重に検討すべき課題と機会が混在しています。規制の変更、技術の進歩、消費者行動の変化により、状況は変化しています。この記事では、成長が見込まれる主要な銀行株と、来年注目に値する理由を探ります。

経済情勢

特定の銘柄に飛び込む前に、より広い経済状況を理解することが重要です。世界経済は、COVID-19パンデミックによって引き起こされた混乱から徐々に回復しています。中央銀行は金融政策を調整しており、金利は不安定な時期を経て安定すると予想されています。金利の上昇は通常、純金利マージンの増加につながるため、この環境は銀行の収益性に大きな影響を与える可能性があります。

さらに、デジタルバンキングやフィンテック企業の台頭により、従来の銀行モデルは変化し続けています。大手銀行は、サービスを強化し、競争上の優位性を維持するために、テクノロジーに多額の投資を行っています。そのため、投資家は、イノベーションをビジネスモデルにうまく取り入れている銀行に注目する必要があります。

注目すべき主要銀行株

-

JPモルガン・チェース(JPM)

JPモルガン・チェースは銀行業界の頼れる存在であり、業界の先駆者として見られることが多い。同行は、投資銀行業務、消費者向け銀行業務、資産運用を含む多角的なビジネスモデルにより、一貫して好調な収益を報告している。2025年には、革新的なプラットフォームを通じて顧客エンゲージメントを強化することで、JPモルガンのテクノロジーとデジタル変革への注力が実を結ぶと予想されている。さらに、同行の堅牢なリスク管理慣行により、潜在的な景気後退に対しても優位に立つことができる。

-

バンク・オブ・アメリカ(BAC)

バンク・オブ・アメリカは、2025年に注目すべきもう1つの主要プレーヤーです。同銀行はデジタルバンキングで大きな進歩を遂げており、取引にモバイルアプリを使用する顧客が増えています。この変化は顧客満足度を向上させるだけでなく、運用コストも削減します。強固な資本基盤と、配当と自社株買いを通じて株主に資本を還元するというコミットメントにより、バンク・オブ・アメリカは新年の金利上昇をうまく活用できる立場にあります。

-

ウェルズ・ファーゴ・アンド・カンパニー(WFC)

ウェルズ・ファーゴは近年、規制当局の監視や評判問題など、多くの課題に直面してきました。しかし、同銀行は業務の簡素化と顧客サービスの向上を目的とした変革的な再編プロセスを進めています。これらの取り組みが効果を発揮すれば、ウェルズ・ファーゴは銀行部門でより競争力のある企業として浮上する可能性があります。投資家は、同社のコンプライアンス改善と信頼回復の進捗状況に注目する必要があります。それが株価の回復につながる可能性もあります。

-

シティグループ株式会社 (C)

シティグループは、収益性の向上を目指して業務の合理化とコスト削減に注力してきました。同銀行の国際的なプレゼンスは、特に銀行の浸透度がまだ低い新興市場において、独自の成長機会を提供しています。世界貿易と投資の流れが増加する中、シティグループはこうしたトレンドの恩恵を受ける好位置にいます。さらに、デジタル バンキング機能を強化するための継続的な取り組みにより、若い顧客層を引き付け、さらなる成長が促進される可能性があります。

-

ゴールドマン・サックス・グループ(GS)

ゴールドマン・サックスは伝統的に投資銀行業務の実力で知られているが、同社はオンライン銀行のマーカスを通じて消費者向け銀行業務を拡大している。この多様化戦略は、金利上昇に伴う同社の収益源の強化が期待されている。銀行サービスにデジタルプラットフォームを利用する消費者が増えるにつれ、ゴールドマン・サックスの革新的なアプローチは大幅な成長をもたらす可能性があり、2025年には注目株となるだろう。

技術革新

銀行業務におけるテクノロジーの統合は、将来の成長にとって極めて重要です。デジタル変革を優先する銀行は、競争が激化する市場で顧客を引きつけ、維持できる可能性が高くなります。人工知能、機械学習、ブロックチェーン技術などのイノベーションは、顧客サービス チャットボットから安全な取引処理まで、銀行の運営方法を変えています。

投資家は、テクノロジーに投資するだけでなく、それを活用して効率性を高め、顧客体験を向上させている銀行を探す必要があります。銀行がこうした技術の変化に適応できるかどうかが、長期的な成功の重要な要素となります。

規制環境

規制環境も、2025 年の銀行セクターの形成において重要な役割を果たすでしょう。政府や規制当局が金融環境の変化に対応する中、銀行は収益性を維持しながらコンプライアンスを遵守する必要があります。投資家は、資本要件、融資慣行、消費者保護に影響を与える可能性のある規制の変更を監視する必要があります。

結論

2025 年が近づくにつれ、経済回復、技術の進歩、主要プレーヤーによる戦略的再配置によって、銀行セクターは魅力的な投資機会を提供します。JP モルガン チェース、バンク オブ アメリカ、ウェルズ ファーゴ、シティグループ、ゴールドマン サックスは、投資家が注意深く監視すべき銘柄です。より広範な経済状況とこれらの銀行の個々の戦略を理解することで、投資家は財務目標に沿った情報に基づいた決定を下すことができます。

このダイナミックな環境において、市場動向とこれらの銀行の業績を常に把握しておくことは、来年の投資環境をうまく乗り切るために不可欠です。

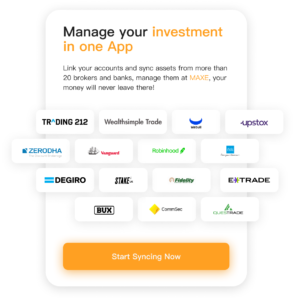

投資に関する詳細については、当社のアプリ「MAXE: 革新的な AI 金融投資管理アプリ」をダウンロードしてください。米国の株式、証券、先物、為替レート、その他の資産情報に関するリアルタイムの更新を取得し、より迅速な投資判断に役立ちます。

MAXEは世界中のユーザーにサービスを提供しています。現在、MAXEアプリをダウンロードしたユーザーの累計数は30万人を超えています。このマイルストーンは、ますます多くの個人がMAXEの価値を認識し、投資と財務管理戦略を最適化するためにアプリを利用していることを示しています。