MAXE ファイナンシャル マーケット コンサルティング: 米国経済カレンダー

10月28日月曜日

予定なし

10月29日火曜日

午前9時 S&Pケース・シラー住宅価格指数(20都市)

午前10時 消費者信頼感

午前10時 求人情報

2024年第4四半期に注目すべき国際株式市場:

2024 年の終わりが近づくにつれ、投資家は潜在的な機会を見極めるために株式市場の状況を注意深く評価しています。12 月は、年末のパフォーマンス指標が作用し、市場が新年に向けて準備を整えるため、しばしばボラティリティが顕著になる極めて重要な月です。この記事では、12 月に注目すべき重要な米国株を取り上げ、そのパフォーマンス、市場状況、潜在的な触媒を徹底的に分析します。

-

テクノロジー部門: NVIDIA Corporation (NVDA)

NVIDIA は、特にグラフィックス プロセッシング ユニット (GPU) と人工知能 (AI) の分野で、一貫してテクノロジー分野の先駆者であり続けています。2024 年 12 月現在、同社はいくつかの主要なトレンドから恩恵を受ける立場にあります。

AIと機械学習の需要:

AI アプリケーションが業界全体に拡大するにつれ、NVIDIA のデータセンター収益は堅調に成長すると予想されています。アナリストは、AI インフラストラクチャへの継続的な投資により、NVIDIA の地位がさらに強化されると予測しています。

ゲーム市場の回復:

ゲーム業界はパンデミック後に回復し始めており、NVIDIA の最新の GPU 製品はホリデー シーズン中に消費者の大きな関心を集めると思われます。

株価パフォーマンス:

投資家は、12月中旬に予定されているNVIDIAの収益報告を注視すべきだ。この報告は同社の成長軌道についての洞察をもたらす可能性がある。

-

ヘルスケア部門: ユナイテッドヘルスグループインコーポレイテッド (UNH)

ユナイテッドヘルス グループは、多様なヘルスケア製品と保険サービスを提供するヘルスケア分野のリーダーとして際立っています。今年 12 月の同社の重要性に貢献する主な要因は次のとおりです。

政策の変更と医療改革:

政治情勢が変化するにつれ、ユナイテッドヘルスは新たな医療政策の影響を受ける可能性があります。投資家は、これらの変化が同社の事業と収益性にどのような影響を与えるかを評価する必要があります。

堅調な収益成長:

ユナイテッドヘルスは一貫して好調な収益を報告している。アナリストは、ヘルスケアサービスの需要増加と高齢化人口の増加により、この傾向が続くと予想している。

配当の安定性:

安定した配当金で知られるユナイテッドヘルスは、収益を求める投資家にとって依然として魅力的な選択肢です。

-

消費者向け製品: Amazon.com, Inc. (AMZN)

Amazon は依然として一般消費財セクターの要です。ホリデー ショッピング シーズンを迎えるにあたり、Amazon が注目すべき銘柄となる要因がいくつかあります。

電子商取引の優位性:

特にホリデーシーズン中のオンラインショッピングの急増により、Amazon は大きな市場シェアを獲得する態勢が整っています。同社の物流機能とプライム会員モデルは、顧客の忠誠心と維持率を高めます。

新規市場への進出:

アマゾンはヘルスケア、広告、クラウドサービス(AWS)への進出により収益源の多様化を続けており、電子商取引のみへの依存を減らしている。

市場センチメント:

アマゾンの株に対する投資家の感情はホリデーシーズンの売上報告に基づいて変動する可能性があるため、12月は分析にとって重要な月となる。

-

金融セクター: JPモルガン・チェース (JPM)

JPモルガン・チェースは米国最大の金融機関の一つとして、金融セクターにおいて重要な役割を担っています。12月は投資家にとっていくつかの考慮すべき点があります。

金利環境:

連邦準備制度理事会の金融政策が金利に影響を与えるため、JPモルガンの純利息収入は大きな影響を受ける可能性がある。投資家は金利の引き上げや引き下げに関する連邦準備制度理事会の決定を注視する必要がある。

収益の回復力:

JPモルガンは、さまざまな経済サイクルを通じて回復力を発揮してきました。投資銀行業務、資産運用業務、消費者向け銀行業務を含む多角的なビジネスモデルにより、経済変動をうまく乗り切ることができます。

自社株買いと配当:

同社は配当金や自社株買いを通じて株主に資本を還元する方針で、不安定な市場において同社の魅力を高める可能性がある。

-

エネルギー部門: エクソンモービルコーポレーション (XOM)

12月に入っても、原油価格の変動と地政学的緊張が続く中、エクソンはエネルギー部門の主要プレーヤーであり続けています。

原油価格の変動:

投資家は、地政学的出来事や OPEC+ の決定に影響を受ける可能性がある世界の原油価格を注意深く監視する必要があります。エクソンの株価は、これらの動向と密接に結びついています。

再生可能エネルギーへの移行:

エクソンは再生可能エネルギー技術に投資しており、エネルギー部門の発展に伴い成長の機会が生まれる可能性がある。同社の炭素回収・貯蔵戦略は長期的には有利な立場に立つ可能性がある。

配当利回り:

エクソンは配当支払いの実績が豊富であるため、収益重視の投資家にとって魅力的な選択肢となっています。

結論

2024 年 12 月が進むにつれて、これらの重要な株式は米国市場における大きなチャンスとリスクを表しています。投資家は、これらの企業の個々の業績だけでなく、より広範な経済指標と市場動向も考慮して、徹底したデューデリジェンスを実施する必要があります。この重要な月に情報に基づいた投資決定を行うには、収益報告、規制の変更、マクロ経済要因に関する情報を常に把握しておくことが重要です。これらの主要プレーヤーに焦点を当てることで、投資家は新年に向けて潜在的な利益に向けて戦略的にポジションを取ることができます。

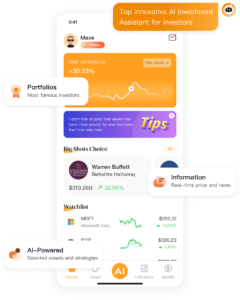

投資に関する詳しい情報については、当社のアプリ「MAXE: 革新的な AI 金融投資管理アプリ」をダウンロードしてください。米国の株式、証券、先物、為替レート、その他の資産情報に関する最新情報をリアルタイムで入手して、より迅速な投資判断を下せるようにします。

MAXEは世界中のユーザーにサービスを提供しています。現在、MAXEアプリをダウンロードしたユーザーの累計数は30万人を超えています。このマイルストーンは、ますます多くの個人がMAXEの価値を認識し、投資と財務管理戦略を最適化するためにアプリを利用していることを示しています。