2025 年が近づくにつれ、テクノロジー セクターは、イノベーション、デジタル変革、およびあらゆる業界でのテクノロジーへの依存度の高まりによって、急速に進化し続けています。投資家は、強力なファンダメンタルズを示すだけでなく、新興市場やテクノロジーで成長の可能性を示すテクノロジー株にますます注目しています。この記事では、2025 年に注目すべき有望なテクノロジー株をいくつか取り上げ、そのビジネス モデル、市場での地位、成長の見通しを探ります。

-

NVIDIA コーポレーション (NVDA)

NVIDIA は、グラフィックス プロセッシング ユニット (GPU) と人工知能 (AI) のリーダーとしての地位を確立しています。同社の GPU は、高性能コンピューティング、ゲーム、データ センターの基盤となっています。さまざまな分野で AI アプリケーションが普及する中、NVIDIA は自社製品に対する需要の高まりから大きな恩恵を受ける態勢が整っています。

2025年には、NVIDIAがAI主導のソリューション、特に自動運転車やヘルスケアなどの分野に進出することで、同社の収益源が強化される可能性が高い。同社のAIコンピューティングにおける最近の進歩と大手テクノロジー企業との提携は、明るい未来を示唆している。投資家は、NVIDIAが革新を続け、市場シェアを拡大していくのを注意深く見守るべきだろう。

-

マイクロソフトコーポレーション (MSFT)

マイクロソフトは、クラウド コンピューティング、生産性ソフトウェア、ゲームなど多角的なビジネス モデルを展開し、テクノロジー業界の主要企業として君臨し続けています。同社の Azure プラットフォームは飛躍的な成長を遂げ、Amazon Web Services (AWS) の強力な競合企業としての地位を確立しています。

2025 年には、企業がクラウド ソリューションやハイブリッド ワーク モデルを採用するケースが増えており、マイクロソフトはこのトレンドを活かすことが期待されています。Microsoft 365 などのソフトウェア製品内での AI 統合に注力することで、同社の価値提案はさらに強化されます。強力なバランスシートとイノベーションへの取り組みにより、マイクロソフトは注目に値するテクノロジー株です。

-

メタプラットフォームズ株式会社 (META)

以前は Facebook として知られていた Meta Platforms は、メタバースと拡張現実 (AR) への移行を進めながら、困難な状況を切り抜けようとしています。プライバシーの問題や競争に関する厳しい監視に直面しているにもかかわらず、Meta は仮想現実と拡張現実の技術に投資しており、この急成長分野における潜在的なリーダーとしての地位を確立しています。

Meta は 2025 年までに、ソーシャル インタラクションと商取引を再定義できるような没入型体験を生み出すことを目指しています。AR 分野での提携や買収、そして膨大なユーザー ベースを組み合わせることで、大きな収益化の機会が生まれる可能性があります。投資家にとって、Meta は将来に向けた野心的なビジョンを考えると、リスクは高いがリターンも大きいチャンスです。

-

テスラ株式会社 (TSLA)

テスラは電気自動車 (EV) 市場の先駆者であり続け、革新的な製品で自動車技術の限界を押し広げています。同社は自動車業界に革命をもたらしただけでなく、エネルギー貯蔵や太陽光発電製品でも大きな進歩を遂げています。

2025年を見据えると、テスラの国際市場への進出と、より手頃な価格のモデルを含む製品ラインナップの多様化計画は、大幅な成長を牽引する可能性があります。さらに、バッテリー技術と自動運転機能の進歩は、テスラの競争力を高める可能性があります。投資家は、テスラが生産を拡大し、EVセクターでの市場リーダーシップを維持する能力を監視すべきです。

-

パランティア・テクノロジーズ(PLTR)

Palantir は、政府機関や商業顧客向けのビッグデータ分析とソフトウェア ソリューションを専門としています。Palantir Gotham や Palantir Foundry などの同社のプラットフォームにより、組織はデータに基づく意思決定を行うことができます。これは、今日の情報過多の環境では極めて重要な機能です。

業界が業務効率と戦略的洞察のためにデータ分析を優先する傾向が強まるにつれ、パランティアの重要性は増すだろう。2025年までに、ヘルスケアや金融などの新しい分野への拡大に重点を置き、戦略的パートナーシップと組み合わせることで、収益が大幅に増加する可能性がある。投資家は、パランティアの契約獲得能力と拡大努力に注目する必要がある。

-

アドバンスト・マイクロ・デバイセズ社(AMD)

AMD は半導体業界で大きな市場シェアを獲得しており、特に CPU と GPU で Intel や NVIDIA と直接競合しています。AI、ゲーム、データ センターの台頭により AMD 製品に対する需要が高まり、堅調な成長が見込まれています。

半導体不足が続いており、技術インフラへの投資が増加しているため、AMD は 2025 年に向けて好位置につけています。チップ アーキテクチャの開発やパフォーマンス強化などのイノベーションに注力することが、競争力を維持する鍵となります。成長するテクノロジー環境を有効活用することを目指している AMD の製品発売と市場戦略を投資家は注視する必要があります。

結論

2025 年に向けて、テクノロジー セクターは洞察力のある投資家にとって数多くの投資機会を提供します。NVIDIA、Microsoft、Meta Platforms、Tesla、Palantir、AMD などの企業は、それぞれの分野をリードしているだけでなく、新たなトレンドやテクノロジーを活用する立場にあります。テクノロジー株への投資には固有のリスクが伴いますが、これらの有望な企業から得られる潜在的な利益は相当なものである可能性があります。投資家は、常に徹底的な調査を行い、ダイナミックなテクノロジー環境をナビゲートする際にはリスク許容度を考慮する必要があります。

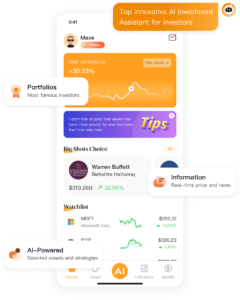

投資に関する詳細については、当社のアプリ「MAXE: 革新的な AI 金融投資管理アプリ」をダウンロードしてください。米国の株式、証券、先物、為替レート、その他の資産情報に関するリアルタイムの更新を取得し、より迅速な投資判断に役立ちます。

MAXEは世界中のユーザーにサービスを提供しています。現在、MAXEアプリをダウンロードしたユーザーの累計数は30万人を超えています。このマイルストーンは、ますます多くの個人がMAXEの価値を認識し、投資と財務管理戦略を最適化するためにアプリを利用していることを示しています。