2024年12月12日 – ナスダック総合指数は歴史的な節目として初めて20,000ポイントの大台を超え、1.77%の大幅な上昇を経て20,034.89ポイントで取引を終えた。同指数はテスラやグーグルの親会社アルファベットなど主要ハイテク株の大幅な上昇に牽引され、日中最高値の20,555.93ポイントに達した。

アルファベットの株価は5.52%上昇し、$195.40で取引を終え、時価総額は$2.39兆ドルとなった。株価は日中最高値$196.11を記録し、史上最高値を更新した。同様に、テスラの株価は5.93%上昇し、$424.77となり、同社の時価総額は約$1.36兆ドルとなり、日中最高値は$424.88ドルとなった。

11月以来、テスラの株価が継続的に上昇したことで、CEOのイーロン・マスク氏の資産は大幅に増加し、同氏は純資産が1兆7千億4千万ドルを超える世界初の億万長者となった。

他のハイテク大手も、この市場上昇中に大幅な利益を経験した。アマゾンの株価は2.32%上昇して$230.26に達し、時価総額は約$2.42兆ドルとなった。一方、メタの株価は2.16%上昇して$632.68となり、時価総額は約$1.60兆ドルとなった。

マクロ経済面では、市場が開く前に発表された米国労働省の11月のインフレデータは予想とほぼ一致しており、トレーダーは連邦準備制度理事会の利下げの可能性に賭ける姿勢を強めている。CMEのFedWatchツールは、来週水曜日に25ベーシスポイントの利下げが行われる確率が90%以上あることを示している。

USバンク・アセット・マネジメントのシニア投資ストラテジスト、トム・ヘインリン氏は「市場は上昇傾向にあり、年末まで上昇を続けるのを妨げる要因はない」と述べた。

さらに、全米独立企業連盟(NFIB)は、中小企業信頼感指数が11月に8ポイント上昇して101.7となり、2021年6月以来の高水準に達したと報告した。アナリストらは、米国の中小企業が、水曜日遅くにニューヨークに到着し、木曜日の朝にニューヨーク証券取引所で取引開始のベルを鳴らすと予想されるトランプ次期大統領に対して好意的な見方をしていると示唆している。

報道によると、グーグルは2日前に量子コンピューターに適した強力なチップを開発していると発表したことを受けて、4日連続で株価が上昇する見込みで、これがハイテク株全体の大幅な上昇につながっている。ウォール街の業界関係者の多くは、この市場動向に関する関連情報を早くから入手し、それに応じて投資ポートフォリオを調整し、より大きな利益を得た。

しかし、一般人はどうやってこの情報にアクセスすればいいのでしょうか。どのセクターが上昇しそうかというニュースを受け取ったとしても、間違った特定の株を買うと大きな損失を被ることになります。では、一般人はどうやって大企業の戦略を参考にして資産ポートフォリオを調整すればいいのでしょうか。

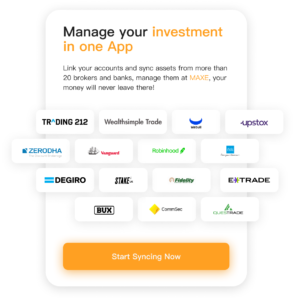

「これらの課題に対処するため、革新的な投資追跡アプリである MAXE は、投資家がニーズに合った資産ポートフォリオを見つけられるよう支援することに専念しています」と MAXE の CEO は述べています。「当社は、著名な投資家、ファンドマネージャー、政府関係者のポートフォリオに直接アクセスできるようにしています。リアルタイムの変化を追跡することで、ユーザーは金融市場の複雑さを自信を持って乗り越えることができます。この機能により、投資家の妨げとなる情報の障壁が取り除かれ、市場動向に関する最新情報が提供されます。その結果、ユーザーはポートフォリオをタイムリーに調整し、業界リーダーの戦略に合わせることができます。」

MAXE は、著名な投資家、ファンドマネージャー、政府関係者など、影響力のある人物の投資ポートフォリオを調べるユニークな機会を一般投資家に提供します。この機能により、ユーザーはこれらの保有資産の重要な変化をリアルタイムで追跡できるため、金融市場によくある大きな情報障壁を克服できます。タイムリーな洞察を提供することで、MAXE はユーザーに市場の動向に関する情報を提供し、業界リーダーの戦略に沿った知識に基づいた決定を下せるようにします。

情報の遅れにより重要な機会を逃す可能性のある投資家をさらに支援するため、MAXE は革新的な AI 財務管理アシスタントを導入しました。この高度なツールはビッグデータと独自のアルゴリズムを利用して、信頼できる情報源から最新の財務情報を収集します。ユーザーは自分の財務状況についてアシスタントに質問し、現在の市場動向とデータ分析を反映したカスタマイズされた投資および財務管理戦略を受け取ることができます。このパーソナライズされたアプローチにより、ユーザーはより効果的に市場をナビゲートし、戦略的意思決定を強化できます。

さらに、MAXE は、株式、債券、商品、外国為替など、さまざまな人気資産に関するリアルタイムの市場データを提供します。情報は、複雑なデータを簡素化して理解しやすくする魅力的な視覚化を通じて提供されます。MAXE は、ニュースの更新、金融動向、規制書類など、ユーザーが関心を持つ資産に関する包括的な詳細も集約します。この徹底した編集により、ユーザーは選択した資産について総合的な見解を得ることができ、情報に基づいた投資決定を下すことができます。

これらの機能の即時性は、市場機会を活用したい人にとって特に価値があります。成功した投資家の戦略を分析することで、ユーザーは効果的な手法と配分モデルを採用し、投資アプローチを改良することができます。この継続的な学習プロセスにより、健全な投資慣行に対する理解が深まるだけでなく、情報に基づいた意思決定の文化も育まれます。最終的に、MAXE は一般の投資家に、金融市場の複雑さをより高い自信と明確さで乗り切るために必要なツールを提供し、投資環境においてより熟練した参加者へと変貌させます。

MAXE は世界中のユーザーにサービスを提供しており、これまでにアプリのダウンロード数は 30 万回を超えています。このマイルストーンは、投資および財務管理戦略を強化するためにアプリを利用する個人が増えていることを反映しており、MAXE の価値に対する認識が高まっていることを反映しています。

MAXEは現在、 グーグルプレイ そして App Store! 従来の財務管理方法に別れを告げ、MAXEで財務の未来に踏み出しましょう。詳細については、当社のウェブサイトをご覧ください。 ホームページ 財務管理に関する最新情報やヒントを入手するには、ソーシャル メディアでフォローしてください。