세계 경제가 계속 진화함에 따라 영국과 미국 시장 간의 상호 작용은 독특한 투자 기회를 제공합니다. 2025년이 다가오면서 여러 영국 주식이 혁신 기술, 소비자 선호도 변화, 팬데믹 이후 경제 회복과 같은 요인에 의해 미국 시장에서 상당한 파장을 일으킬 준비가 되었습니다. 이 기사에서는 투자자가 대서양 투자의 복잡성을 헤쳐 나갈 때 주목해야 할 가장 유망한 영국 기업을 살펴봅니다.

-

AstraZeneca: 제약 분야의 선두주자

AstraZeneca는 특히 COVID-19 백신 개발에서 중요한 역할을 한 이후 글로벌 제약 산업의 핵심 기업으로서의 입지를 굳건히 했습니다. 암 치료제, 심혈관 질환, 호흡기 질환을 포함한 이 회사의 강력한 파이프라인은 향후 몇 년 동안 성장을 견인할 것으로 예상됩니다. AstraZeneca는 개인화된 의학과 바이오제약에 점점 더 집중하면서 미국 시장에서 혁신적인 의료 솔루션에 대한 수요가 증가하는 것을 활용할 수 있는 좋은 위치에 있습니다.

분석가들은 AstraZeneca의 미국 진출이 전략적 파트너십과 인수에 의해 촉진될 것이며, 최첨단 치료법을 제공하는 능력을 강화할 것이라고 예측합니다. 투자자들은 회사가 규제 문제와 시장 경쟁, 특히 Pfizer와 Johnson & Johnson과 같은 미국 거대 기업과의 경쟁을 어떻게 헤쳐 나가는지 지켜봐야 합니다.

-

유니레버: 소비재 강자

유니레버는 오랫동안 소비재 부문의 주요 기업으로, 식품과 음료부터 개인 관리 제품에 이르기까지 광범위한 브랜드 포트폴리오로 유명합니다. 지속 가능성과 혁신에 대한 강력한 의지를 바탕으로 유니레버는 특히 친환경 제품을 우선시하는 젊은 세대의 변화하는 소비자 선호도에 적응하고 있습니다.

디지털 혁신과 전자상거래에 대한 회사의 전략적 초점은 미국에서의 시장 입지를 강화할 것으로 기대됩니다. 지속 가능한 제품에 대한 수요가 계속 증가함에 따라, 유니레버가 브랜드 자산을 활용하고 제품 제공을 확장하는 능력은 2025년의 성공에 결정적일 것입니다.

-

Diageo: 음료 산업을 지배하다

글로벌 알코올 음료 시장의 선두주자인 Diageo는 Johnnie Walker, Guinness, Smirnoff를 포함한 다양한 프리미엄 브랜드 포트폴리오를 보유하고 있습니다. 소비자 선호도가 프리미엄 및 수제 음료로 이동함에 따라 Diageo는 이러한 추세를 포착할 전략적 위치에 있습니다.

특히 미국 시장에서 마케팅과 혁신에 대한 회사의 지속적인 투자는 상당한 수익을 낼 가능성이 높습니다. 제품 범위를 확장하고 디지털 마케팅 전략을 강화하는 데 중점을 두고 Diageo는 경쟁 우위를 유지할 준비가 되었습니다. 투자자들은 Diageo가 변화하는 규정과 시장 역학, 특히 건강을 의식하는 소비자 트렌드의 맥락에서 어떻게 적응하는지 모니터링해야 합니다.

-

롤스로이스: 회복력 있는 엔지니어링의 경이로움

엔지니어링의 우수성으로 유명한 Rolls-Royce는 지속 가능한 항공 및 에너지 솔루션으로 전환하면서 중대한 변화를 겪고 있습니다. 저배출 기술 개발에 대한 이 회사의 헌신은 기후 변화에 대처하기 위한 세계적 노력과 일치하여 미국 시장에서 매력적인 투자 기회가 되었습니다.

팬데믹 이후 항공 여행이 회복되면서 Rolls-Royce는 항공우주 부문을 강화하는 데 주력하고 전력 시스템 부문의 전략적 이니셔티브를 결합하여 성장을 위한 입지를 굳혔습니다. 투자자들은 특히 빠르게 변화하는 에너지 환경에서 산업 과제에 혁신하고 적응할 수 있는 회사의 능력에 주의를 기울여야 합니다.

-

BP: 전환하는 에너지 거대 기업

BP는 전통적인 화석 연료에서 재생 에너지원으로 초점을 옮기면서 상당한 변화를 겪고 있습니다. 2050년까지 순 제로 배출 기업이 되겠다는 회사의 야심 찬 목표는 지속 가능성과 혁신에 대한 회사의 헌신을 나타냅니다.

풍력, 태양광, 수소 에너지에 상당한 투자를 한 BP는 미국에서 증가하는 청정 에너지 수요를 활용할 수 있는 좋은 위치에 있습니다. 저탄소 경제로의 전환이 가속화됨에 따라 BP가 규제 프레임워크와 시장 변화를 탐색하는 능력은 성공에 매우 중요합니다. 투자자는 BP가 전환 전략을 실행하는 데 있어 진행 상황과 회사의 재무 실적에 미치는 영향을 모니터링해야 합니다.

결론

2025년을 바라보면서 영국과 미국 시장의 상호작용은 투자자들에게 풍부한 기회를 제공합니다. AstraZeneca, Unilever, Diageo, Rolls-Royce, BP와 같은 회사는 혁신, 지속 가능성, 적응력에 의해 주도되어 미국 시장에 상당한 영향을 미칠 준비가 되어 있습니다.

투자자는 시장 동향, 규제 환경, 소비자 행동과 같은 요소를 고려하여 이러한 주식을 모니터링하는 데 계속 주의를 기울여야 합니다. 정보를 얻고 이러한 회사를 전략적으로 분석함으로써 투자자는 2025년 미국 시장에서 영국 주식의 유망한 전망을 활용할 수 있는 입지를 굳건히 할 수 있습니다.

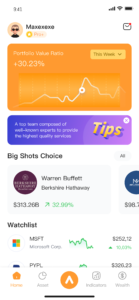

더 많은 투자 정보를 원하시면, 저희 앱을 다운로드하세요: MAXE: 혁신적인 AI 금융 투자 관리 앱. 미국 주식, 증권, 선물, 환율 및 기타 자산 정보에 대한 실시간 업데이트를 받아 더 빠른 투자 결정을 내리는 데 도움을 받으세요.

MAXE는 전 세계 사용자에게 서비스를 제공합니다. 지금까지 MAXE 앱을 다운로드한 누적 사용자 수는 300,000명을 넘었습니다. 이 이정표는 점점 더 많은 개인이 MAXE의 가치를 인식하고 APP를 활용하여 투자 및 재무 관리 전략을 최적화하고 있음을 나타냅니다.

이제 MAXE를 사용할 수 있습니다. Google Play 그리고 App Store. MAXE와 함께 전통적인 재무 관리 방식에 작별을 고하고 금융의 미래를 받아들이세요.