As we look ahead to 2025, investors are increasingly focused on the interconnectedness of global markets, particularly the influence of Asian stocks on U.S. equities. The Asian financial landscape has been evolving rapidly, driven by technological advancements, demographic shifts, and changing economic policies. This article explores Asian stocks that are poised to have significant impacts on U.S. markets in the coming years.

The Growing Importance of Asia

In recent years, Asia has emerged as a powerhouse of economic growth, outpacing many Western economies. Countries such as China, India, and Southeast Asian nations have seen robust GDP growth, driven by a combination of industrialization, urbanization, and a burgeoning middle class. As these economies expand, their companies are increasingly recognized as key players in the global market.

The Asian stock market not only offers investment opportunities but also reflects broader economic trends that can influence U.S. markets. With many U.S. Companies reliant on Asian supply chains and consumer bases, shifts in the Asian markets can have ripple effects across the Atlantic.

Key Sectors to Watch

Technology

The technology sector, particularly in China and India, will likely be at the forefront of this influence. Companies such as Alibaba, Tencent, and Infosys have established themselves as leaders in e-commerce, social media, and IT services. As these firms continue to innovate and expand, they will attract attention from U.S. investors looking for growth opportunities.

In addition, advancements in artificial intelligence (AI) and fintech are set to transform industries globally. Asian tech firms are investing heavily in these areas, and their success could lead to increased collaborations with U.S. companies, enhancing their stock values and market presence.

Renewable Energy

Another sector to watch is renewable energy. As the world grapples with climate change, Asian countries are investing significantly in sustainable energy sources. China, in particular, is a leader in solar panel production and electric vehicle (EV) manufacturing. Companies like NIO and BYD are not only reshaping the automotive landscape but also setting trends that U.S. Manufacturers will need to follow to remain competitive.

With the U.S. government emphasizing clean energy initiatives, the collaboration between Asian and American renewable energy firms could lead to a surge in stock prices for companies involved in this sector.

Consumer Goods

The consumer goods sector is also witnessing significant shifts. As the middle class grows in Asia, demand for high-quality consumer products is rising. Brands such as Uniqlo and Xiaomi are capitalizing on this trend. U.S. Investors should monitor how these companies expand their market share both domestically and internationally, as their performance will likely impact U.S. retailers and manufacturers.

Geopolitical Considerations

While the potential for growth is significant, investors must also navigate the complexities of geopolitical tensions that could affect Asian stocks. The ongoing trade relationships between the U.S. and China, for instance, remain a critical factor. Policies regarding tariffs, trade agreements, and regulations can create volatility in stock prices.

Furthermore, regional tensions in areas such as the South China Sea or Taiwan can impact investor sentiment. A stable geopolitical environment will be crucial for the sustained growth of Asian stocks and their influence on U.S. markets.

The Role of Exchange-Traded Funds (ETFs)

For U.S. investors looking to gain exposure to Asian markets, exchange-traded funds (ETFs) provide a viable option. These funds allow investors to diversify their portfolios without the need to directly purchase foreign stocks. Popular ETFs focusing on Asian markets include the iShares Asia 50 ETF and the Invesco Asia Pacific Ex-Japan ETF, which track a range of companies across the region.

As these ETFs gain popularity, they will likely play a pivotal role in amplifying the impact of Asian stocks on U.S. markets. Increased investment in these funds can lead to heightened price movements in underlying Asian equities, creating a more significant influence on U.S. market dynamics.

Conclusion

In conclusion, as we approach 2025, the influence of Asian stocks on U.S. markets is expected to grow. Key sectors such as technology, renewable energy, and consumer goods will play crucial roles in this dynamic. However, investors must remain vigilant regarding geopolitical risks that could impact market stability.

By understanding the trends and developments within Asian markets, U.S. investors can better position themselves to capitalize on the opportunities that lie ahead. The interconnectedness of global economies means that the performance of Asian stocks will not only shape the financial landscape in Asia but also reverberate throughout the U.S. markets, making them essential to watch in the coming years.

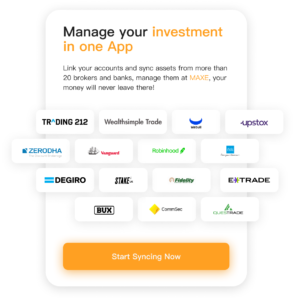

For more information on investment, download our app: MAXE: The Revolutionary AI Financial Invest Management App. Get real-time updates on US stocks, securities, futures, exchange rates, and other asset information to help you make faster investment decisions.

MAXE serves users around the globe. As of now, the cumulative number of users who have downloaded the MAXE app has exceeded 300,000. This milestone indicates that an ever-growing number of individuals recognize the value of MAXE and are utilizing the APP to optimize their investment and financial management strategies.

Now, MAXE is available on Google Play and App Store . Say goodbye to traditional financial management methods and embrace the future of finance with MAXE.