MAXE Financial Markets Consulting: US Economic Calendar

MONDAY, NOV. 11

Veteran’s Day holiday, bond market closed

TUESDAY, NOV. 12

6:00 am NFIB optimism index Oct.

10:00 am Fed Gov. Christopher Waller speaks

10:15 am Richmond Fed President Tom Barkin speaks

5:00 pm Philadelphia President Patrick Harker speaks

Top Bank Stocks to Monitor in December 2024:

As we approach the end of 2024, investors are keenly observing the banking sector, which has shown resilience amid fluctuating economic conditions. With interest rates stabilizing and inflation showing signs of moderation, several bank stocks are positioned for potential growth as we head into December. This article highlights key bank stocks to watch, along with the factors driving their performance.

-

JPMorgan Chase & Co. (JPM)

JPMorgan Chase, the largest bank in the United States, has consistently remained a strong performer in the financial sector. The bank’s diversified business model, encompassing investment banking, consumer and community banking, and asset management, provides a robust foundation for growth.

Recent Developments

In 2024, JPMorgan has focused on expanding its digital banking services, enhancing customer engagement through technology. The bank reported a significant increase in its mobile banking user base, which is expected to drive further growth in deposits and fee income.

Outlook

Analysts are bullish on JPMorgan, citing its strong capital position and ability to navigate economic uncertainties. With the Federal Reserve’s interest rate policy becoming more predictable, JPMorgan is well-positioned to benefit from a potential uptick in net interest income.

-

Bank of America (BAC)

Bank of America has emerged as a leader in the banking sector, thanks to its focus on consumer banking and wealth management. The bank’s strong brand loyalty and extensive branch network contribute to its robust deposit base.

Performance Metrics

The bank has reported solid earnings growth in 2024, driven by an increase in loan demand and a higher interest rate environment. Additionally, Bank of America has been actively managing its expenses, which has positively impacted its profit margins.

Future Prospects

As the economy stabilizes, Bank of America is likely to see an increase in lending, particularly in commercial and residential real estate. Analysts suggest that the bank’s investments in technology will continue to enhance operational efficiency and customer satisfaction.

-

Wells Fargo & Co. (WFC)

Wells Fargo has faced significant challenges in recent years, including regulatory scrutiny and management changes. However, the bank is undergoing a transformation aimed at restoring its reputation and improving profitability.

Strategic Initiatives

In 2024, Wells Fargo has emphasized restructuring its business model to focus on core banking services and reducing operational risks. The bank has also ramped up its efforts in digital banking, enhancing its online services to attract younger customers.

Investment Rationale

While Wells Fargo’s recovery is still in progress, many analysts believe that its turnaround strategy could yield positive results in the coming years. The bank’s commitment to improving its risk management practices and customer service positions it as a potential growth stock.

-

Citigroup Inc. (C)

Citigroup has been making strides to enhance its profitability and streamline operations. With a global presence and a focus on institutional clients, Citigroup is well-placed to benefit from a rebound in international trade and investment.

Key Drivers

The bank has been focusing on cost-cutting measures and optimizing its balance sheet, which has begun to pay off in terms of improved earnings. Additionally, Citigroup’s wealth management division has shown strong growth, catering to high-net-worth individuals.

Market Position

As global markets stabilize, Citigroup’s international exposure could lead to significant gains. Investors should keep an eye on the bank’s efforts to expand its digital capabilities, which are crucial for attracting younger clients and enhancing overall efficiency.

-

Goldman Sachs Group Inc. (GS)

Goldman Sachs, traditionally known for its investment banking prowess, has been diversifying its revenue streams through consumer banking initiatives. The bank’s foray into digital consumer banking has positioned it as a significant player in this space.

Innovative Offerings

In 2024, Goldman Sachs launched several new financial products aimed at retail investors, which have been well received. The bank’s Marcus platform continues to grow, attracting deposits and offering competitive savings rates.

Growth Outlook

Goldman Sachs is expected to benefit from increased activity in mergers and acquisitions as market conditions stabilize. Moreover, its investment management division is likely to see growth as institutional investors seek out alternatives in a low-return environment.

Conclusion

As December 2024 approaches, the banking sector presents a mixed bag of opportunities for investors. JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and Goldman Sachs each have unique strengths and challenges that could impact their stock performance.

Investors should consider the broader economic context, including interest rate trends and regulatory developments, when evaluating these bank stocks. While the sector faces headwinds, the potential for growth remains strong, making these banks worth monitoring as we head into the new year.

In a rapidly changing financial landscape, staying informed about the performance and strategies of these key players will be essential for making sound investment decisions in the banking sector.

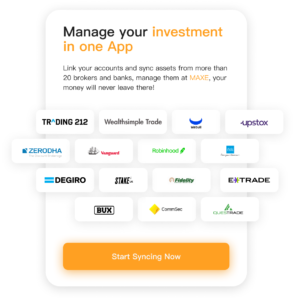

For more information on investment, download our app: MAXE: The Revolutionary AI Financial Invest Management App. Get real-time updates on US stocks, securities, futures, exchange rates, and other asset information to help you make faster investment decisions.

MAXE serves users around the globe. As of now, the cumulative number of users who have downloaded the MAXE app has exceeded 300,000. This milestone indicates that an ever-growing number of individuals recognize the value of MAXE and are utilizing the APP to optimize their investment and financial management strategies.

Now, MAXE is available on Google Play and App Store . Say goodbye to traditional financial management methods and embrace the future of finance with MAXE.