MAXE Financial Markets Consulting: US Economic Calendar

MONDAY, NOV. 4

10:00 am Factory orders

TUESDAY, NOV. 5

8:30 am U.S. trade deficit Sept.

10:00 am ISM services Oct.

Essential US Financial Stocks to Track in December 2024:

As we approach the end of 2024, investors are increasingly turning their attention to the financial sector, which is poised for significant developments. Economic indicators, regulatory changes, and evolving market dynamics are all influencing the performance of financial stocks. Here, we explore several essential US financial stocks that are worth tracking this December, highlighting their recent performance, strategic positioning, and potential catalysts for growth.

-

JPMorgan Chase & Co. (JPM)

JPMorgan Chase, the largest bank in the United States by assets, continues to demonstrate resilience in a fluctuating economic landscape. With its diversified business model encompassing retail banking, investment banking, and asset management, JPMorgan is well-positioned to navigate potential challenges.

In recent quarters, the bank has reported robust earnings driven by strong loan demand and improved net interest margins. Analysts project that JPMorgan will benefit from rising interest rates, which could enhance its profitability in lending. Additionally, the bank’s commitment to digital transformation and technology investments positions it favorably against competitors, making it a stock to watch as we close out the year.

-

Bank of America Corp. (BAC)

Bank of America has been a consistent performer in the financial sector, with a strong focus on consumer banking and wealth management. The bank’s recent earnings report showed a significant increase in net income, primarily attributed to higher interest rates and a growing client base.

Looking ahead, Bank of America is expected to capitalize on the ongoing economic recovery and shifting consumer behaviors. Its investment in technology, particularly in enhancing customer experience through digital platforms, is likely to drive further growth. As interest rates remain elevated, BAC’s stock could see upward momentum, making it a key player to monitor this December.

-

Wells Fargo & Co. (WFC)

Wells Fargo has faced its share of challenges in recent years, including regulatory scrutiny and operational restructuring. However, the bank is showing signs of recovery, with a renewed focus on core banking services and risk management.

Recent strategic initiatives have aimed at enhancing customer trust and returning to profitability. Analysts are optimistic about Wells Fargo’s potential as it streamlines operations and strengthens its balance sheet. With an emphasis on sustainable growth and improved operational efficiency, WFC is a financial stock that could offer significant upside in the coming months.

-

Goldman Sachs Group Inc. (GS)

Goldman Sachs, a leader in investment banking and asset management, is navigating a complex market environment. Despite facing headwinds in its trading division, Goldman has diversified its revenue streams through its consumer banking efforts and asset management services.

The firm’s recent acquisition of fintech companies has bolstered its consumer offerings, positioning it to capture a larger share of the growing digital finance market. As investment banking activity picks up and market conditions stabilize, Goldman Sachs could see renewed investor interest. Keeping an eye on GS this December is advisable, especially in light of its potential to rebound in the evolving financial landscape.

-

BlackRock Inc. (BLK)

As the world’s largest asset manager, BlackRock plays a crucial role in the financial markets. The firm has consistently demonstrated resilience, driven by strong inflows into its exchange-traded funds (ETFs) and investment solutions.

With increasing global interest in sustainable investing, BlackRock’s commitment to environmental, social, and governance (ESG) criteria is likely to attract more investors. The firm’s strategic focus on technology and risk management enhances its competitive edge in the asset management space. As institutional and retail investors continue to seek out sustainable investment opportunities, BlackRock’s stock is one to watch in December.

-

Charles Schwab Corp. (SCHW)

Charles Schwab has made significant strides in the brokerage industry, particularly following its acquisition of TD Ameritrade. The integration of these two firms has expanded Schwab’s market presence and capabilities, enhancing its position as a leading brokerage platform.

As markets become increasingly volatile, retail investors are likely to turn to Schwab for its low-cost trading options and comprehensive investment solutions. The firm’s commitment to innovation and customer service is expected to drive further growth. With a solid outlook for retail investing and a growing customer base, SCHW is an essential stock to track.

Conclusion

As we enter December 2024, the US financial sector presents a promising landscape for investors. Stocks like JPMorgan Chase, Bank of America, Wells Fargo, Goldman Sachs, BlackRock, and Charles Schwab are all positioned to capitalize on current economic trends and market dynamics.

Investors should remain vigilant, as macroeconomic indicators such as interest rates, inflation, and regulatory changes will continue to influence stock performance. By monitoring these essential financial stocks, investors can make informed decisions and potentially capitalize on opportunities in the evolving financial landscape.

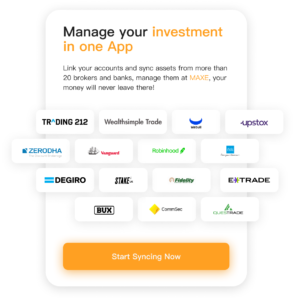

For more information on investment, download our app: MAXE: The Revolutionary AI Financial Invest Management App. Get real-time updates on US stocks, securities, futures, exchange rates, and other asset information to help you make faster investment decisions.

MAXE serves users around the globe. As of now, the cumulative number of users who have downloaded the MAXE app has exceeded 300,000. This milestone indicates that an ever-growing number of individuals recognize the value of MAXE and are utilizing the APP to optimize their investment and financial management strategies.

Now, MAXE is available on Google Play and App Store . Say goodbye to traditional financial management methods and embrace the future of finance with MAXE.