MAXE Financial Markets Consulting: US Economic Calendar

TUESDAY, OCT. 22

10:00 am Philadelphia Fed President Patrick Harker speaks

WEDNESDAY, OCT. 23

9:00 am Fed Governor Michelle Bowman speaks

10:00 am Existing home sales

2:00 pm Fed Beige Book

Promising Global Company Stocks to Track This Quarter:

As we approach the fourth quarter of 2024, investors are increasingly eyeing overseas markets for opportunities that may yield significant returns. Global economic dynamics are shifting, driven by geopolitical tensions, changing consumer behavior, and technological advancements. This analysis will explore several overseas company stocks that stand out due to their potential for growth, resilience, and alignment with emerging trends.

-

Geopolitical Landscape and Investment Sentiment

The geopolitical environment remains a critical factor influencing stock performance globally. The ongoing tensions between major economies, particularly the U.S. and China, have created an atmosphere of uncertainty. However, this also presents investment opportunities, particularly in companies that can navigate these complexities effectively.

Emerging markets, especially in Southeast Asia and Latin America, are becoming increasingly attractive as they diversify their economic ties and reduce reliance on traditional powerhouses. Companies operating in these regions may benefit from favorable demographics and rising middle-class consumption.

-

Tech Giants in Asia

Alibaba Group (BABA)

Alibaba has faced regulatory challenges over the past few years, leading to significant volatility in its stock price. However, recent signs suggest that the Chinese government is moving towards a more lenient regulatory environment for tech companies. As the Chinese economy rebounds, Alibaba is well-positioned to capitalize on e-commerce growth and cloud computing demands. Its diversification into international markets could also provide a buffer against domestic pressures.

Samsung Electronics (005930.KS)

Samsung continues to be a leader in the semiconductor industry, a sector poised for growth as demand for chips surges across various industries, including AI, automotive, and consumer electronics. The company’s investment in R&D and its robust supply chain management will likely allow it to maintain its competitive edge. Furthermore, Samsung’s efforts in sustainability and green technology are aligning with global trends, which could enhance its brand value and investor appeal.

-

European Resilience

ASML Holding (ASML)

ASML, a Dutch semiconductor equipment manufacturer, is crucial to the global tech supply chain. Its monopoly in extreme ultraviolet (EUV) lithography technology positions it uniquely to benefit from the ongoing semiconductor boom. As global demand for chips continues to rise, ASML’s innovative technology will be central to the production of smaller, more powerful chips. The company’s strong financials and ongoing investment in R&D make it a stock worth watching.

LVMH Moët Hennessy Louis Vuitton (MC.PA)

LVMH remains a powerhouse in the luxury goods market, with a diverse portfolio that includes fashion, cosmetics, and spirits. Despite economic uncertainties, the luxury sector has shown resilience, particularly in Asia. LVMH’s strong brand equity and ability to adapt to changing consumer preferences, including a shift towards sustainable luxury, position it well for continued growth. As global travel resumes, the company is likely to benefit from increased spending on luxury goods.

-

Latin American Opportunities

Mercado Libre (MELI)

Mercado Libre, often dubbed the “Amazon of Latin America,” continues to expand its e-commerce and fintech offerings across the region. With a growing user base and increasing internet penetration, the company is well-positioned to capture market share as Latin America transitions to digital retail. Its investments in logistics and payment solutions are enhancing its competitive advantage, making it a stock to watch as consumer habits evolve.

Petrobras (PBR)

Petrobras, Brazil’s state-controlled oil company, is undergoing significant transformations under a new management strategy that focuses on operational efficiency and debt reduction. As global energy markets fluctuate, Petrobras’s ability to adapt to changing oil prices and invest in renewable energy sources could provide substantial upside. Furthermore, Brazil’s political stability post-election may enhance investor confidence in the energy sector.

-

Emerging Trends and Sustainability

Investors increasingly prioritize companies demonstrating strong ESG (Environmental, Social, and Governance) practices. Companies that effectively integrate sustainability into their business models will likely attract a broader investor base.

Ørsted (ORSTED)

As a leader in renewable energy, Ørsted is at the forefront of the transition to sustainable power. The company’s aggressive expansion into offshore wind energy presents a unique opportunity for growth. As governments worldwide commit to reducing carbon emissions, Ørsted’s projects are set to benefit from increased investments in green technologies. This alignment with global sustainability goals positions Ørsted as a compelling investment for environmentally-conscious investors.

Unilever (UL)

Unilever’s commitment to sustainability and social responsibility enhances its brand loyalty among consumers. The company’s focus on reducing plastic waste and improving supply chain transparency aligns with changing consumer values. As markets evolve, Unilever’s diverse product portfolio and strong market presence make it a resilient choice amidst economic fluctuations.

Conclusion

As we head into the fourth quarter of 2024, several overseas company stocks present compelling investment opportunities. From tech giants in Asia to resilient luxury brands in Europe and growth-oriented firms in Latin America, the global landscape is ripe with potential. Investors should remain vigilant, considering geopolitical developments, economic recovery trajectories, and emerging consumer trends. By strategically positioning their portfolios, investors can capitalize on these opportunities, navigating the complexities of the global market with confidence.

In this dynamic environment, diversification across sectors and regions will be key to mitigating risks and maximizing returns. As always, thorough research and a keen understanding of market trends will be essential for making informed investment decisions in the months ahead.

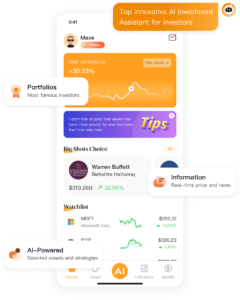

For more investment information, download our app: MAXE: The Revolutionary AI Financial Invest Management App. Get real-time updates on US stocks, securities, futures, exchange rates, and other asset information to help you make faster investment decisions.

MAXE serves users around the globe. As of now, the cumulative number of users who have downloaded the MAXE app has exceeded 300,000. This milestone indicates that an ever-growing number of individuals recognize the value of MAXE and are utilizing the APP to optimize their investment and financial management strategies.

Now, MAXE is available on Google Play and App Store. Say goodbye to traditional financial management methods and embrace the future of finance with MAXE.