In today’s complex and volatile global economy, the Federal Reserve’s decision to cut interest rates has sparked widespread concern and debate. Although the Fed announced a 50 basis point cut in September, which many anticipated would initiate a global rate-cutting cycle, opinions within the U.S. differ significantly. Former Treasury Secretary Summers has voiced opposition, arguing that the U.S. economy is still growing and may see rate hikes again in November. Additionally, unexpectedly strong U.S. economic data has further contributed to market uncertainty. But the third quarter financial reports from the six major Wall Street banks have shown strong performance:

Morgan Stanley reported better-than-expected results on October 16. Third-quarter revenue was $15.38 billion, surpassing the forecast of $14.35 billion. Its wealth management, trading, and investment banking divisions all exceeded expectations, leading to a pre-tax profit of $4.221 billion— a 34% year-on-year increase.

In its October 15 report, Bank of America posted a slight revenue increase to $25.49 billion, above the market expectation of $25.3 billion. However, net profit fell 12% to $6.9 billion compared to last year, and net interest income declined 2.9% to nearly $14 billion, though still better than anticipated.

Of course, Goldman Sachs, JPMorgan Chase, Wells Fargo, and Citigroup also reported solid performances.

Analysts suggest that Wall Street firms continue to post strong financial results in the current complex environment due to their ability to maximize investment returns through timely industry insights and effective collaboration within elite networks. In contrast, ordinary investors often lack these advantages, typically relying on media reports and personal experience to adjust their portfolios. However, investment opportunities can be fleeting, and information may become outdated by the time it reaches the public. Therefore, ordinary investors should explore better strategies to enhance their decision-making.

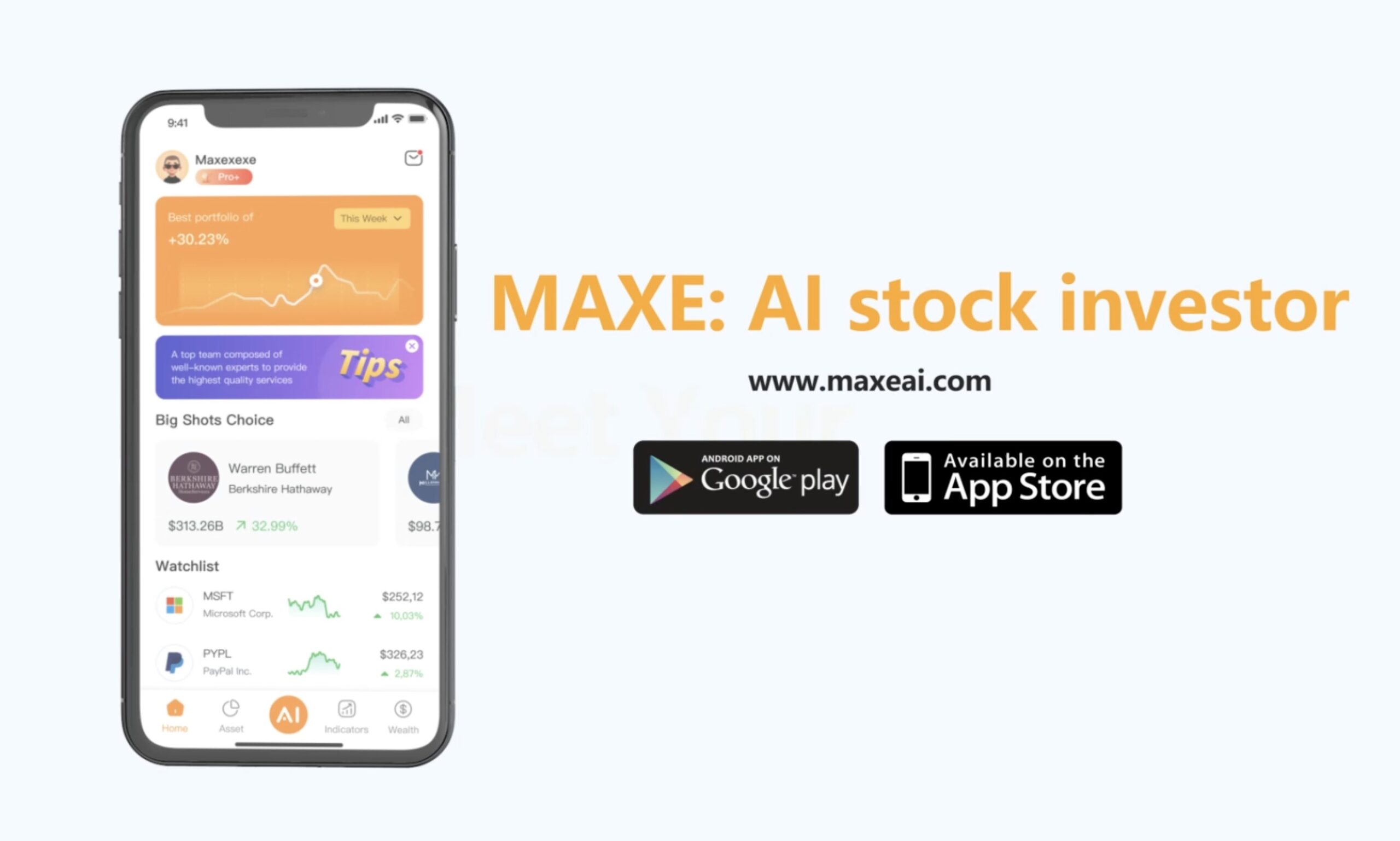

“To tackle these difficulties, MAXE, a leading investment tracking application, helps investors identify the most suitable asset portfolios for their needs,” said the CEO of MAXE. “We provide users access to the portfolios of renowned investors, fund managers, and government officials, tracking real-time changes in their positions. This feature empowers users to overcome information barriers in the financial market, keeping them updated on market shifts and enabling them to adjust their portfolios in line with industry leaders”

MAXE offers users access to the investment portfolios of world-renowned investors, fund managers, and government officials, tracking real-time changes in their positions. This feature helps users break free from the information barriers of the financial market, allowing them to stay updated on market shifts and adjust their asset portfolios in line with industry leaders.

The timeliness of this feature greatly benefits users. By analyzing the decisions of successful investors, users can adopt and adapt proven strategies and allocation models to enhance their investment approaches. This not only deepens their understanding of effective investment practices but also fosters informed decision-making, ultimately empowering average investors to navigate complex markets with greater confidence and clarity.

Additionally, To address the issue of ordinary investors missing valuable opportunities due to limited information and delays, MAXE has introduced an innovative AI financial management assistant. This assistant leverages big data and a proprietary core algorithm to gather the latest financial insights from multiple sources. Users can pose questions based on their circumstances, and the assistant will create a customized investment and financial management strategy that reflects the current market conditions and big data analysis. This tailored approach helps users gain a clear understanding of the market environment.

At the same time, MAXE offers users real-time market data for a wide range of popular assets, including stocks, bonds, and foreign exchange, all presented through data visualization. We also gather comprehensive information on the assets you’re interested in, such as news, financial updates, and regulatory filings, allowing you to gain a well-rounded understanding of those assets from multiple perspectives.

MAXE serves users around the globe. As of now, the cumulative number of users who have downloaded the MAXE app has exceeded 300,000. This milestone indicates that an ever-growing number of individuals recognize the value of MAXE and are utilizing the app to optimize their investment and financial management strategies.

Now, MAXE is available on Google Play and App Store. Say goodbye to traditional financial management methods and embrace the future of finance with MAXE. For more information.