2024 年 12 月 12 日 – 纳斯达克综合指数首次突破20,000点大关,收盘报20,034.89点,涨幅达1.77%,创历史新高。受特斯拉、谷歌母公司Alphabet等主要科技股大幅上涨的推动,该指数盘中最高触及20,555.93点。

Alphabet 股价上涨 5.52%,收于 $195.40,市值为 $2.39 万亿美元。该股盘中最高达到 $196.11,创下历史新高。同样,特斯拉股价上涨 5.93%,至 $424.77,使该公司的市值升至约 $1.36 万亿美元,盘中最高达到 $424.88。

自11月以来,特斯拉股价的连续上涨,大幅提升了首席执行官埃隆·马斯克的财富,使他成为全球第一位净资产超过1.74万亿美元的亿万富翁。

其他科技巨头也在本轮市场反弹中获得了大幅上涨。亚马逊股价上涨 2.32% 至 $230.26,市值约为 $2.42 万亿美元。与此同时,Meta 股价上涨 2.16% 至 $632.68,市值约为 $1.60 万亿美元。

宏观经济方面,美国劳工部开盘前公布的11月通胀数据与预期相近,促使交易员加大对美联储降息的押注。芝加哥商品交易所的FedWatch工具显示,下周三降息25个基点的可能性超过90%。

美国银行资产管理公司高级投资策略师汤姆·海因林表示,“市场一直呈上升趋势,年底前没有任何因素阻止其继续上涨。”

此外,美国全国独立企业联合会(NFIB)报告称,11月份小企业信心指数上升8点,至101.7,为2021年6月以来的最高水平。分析师表示,美国小企业对当选总统特朗普持乐观态度,预计特朗普将于周三晚抵达纽约,并于周四上午敲响纽约证券交易所的开市钟。

据报道,谷歌有望连续四天上涨,两天前该公司宣布将开发适用于量子计算机的强大芯片,这导致科技股整体大幅上涨。华尔街的许多业内人士较早收到了有关这一市场趋势的信息,并据此调整了投资组合,从而获得了更大的利润。

但普通人如何获得这些信息呢?即使他们知道哪些板块可能会上涨,买错股票也会导致巨额损失。那么普通人如何参考商业巨头的策略来调整自己的资产组合呢?

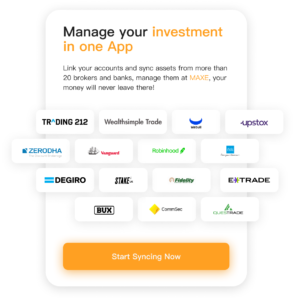

“为了应对这些挑战,MAXE 是一款创新的投资跟踪应用程序,致力于帮助投资者找到适合自己需求的资产组合,”MAXE 首席执行官表示。“我们让用户直接访问受尊敬的投资者、基金经理和政府官员的投资组合。通过跟踪实时变化,我们让用户能够自信地应对金融市场的复杂性。此功能消除了阻碍投资者的信息障碍,让他们随时了解市场发展情况。因此,用户可以及时调整投资组合,使他们的策略与行业领导者的策略保持一致。”

MAXE 为日常投资者提供了一个独特的机会,让他们探索有影响力人物的投资组合,包括知名投资者、基金经理和政府官员。此功能允许用户实时跟踪这些持股的重大变化,帮助他们克服金融市场中经常出现的巨大信息障碍。通过提供及时的见解,MAXE 让用户随时了解市场动态,使他们能够做出符合行业领导者战略的明智决策。

为了进一步帮助那些可能因信息延迟而错失关键机会的投资者,MAXE 推出了一款创新的人工智能财务管理助手。这款先进的工具利用大数据和专有算法从可靠来源收集最新的财务见解。用户可以与助手互动,询问他们的财务状况,并获得反映当前市场趋势和数据分析的定制投资和财务管理策略。这种个性化的方法使用户能够更有效地驾驭市场并增强他们的战略决策能力。

此外,MAXE 还提供各种热门资产的实时市场数据,包括股票、债券、商品和外汇。信息通过引人入胜的可视化呈现,简化了复杂的数据,使其更易于理解。MAXE 还汇总了有关用户感兴趣的资产的全面详细信息,例如新闻更新、财务发展和监管备案。这种全面的汇编可帮助用户全面了解他们选择的资产,从而支持明智的投资决策。

这些功能的即时性对于那些希望利用市场机会的人来说尤其有价值。通过分析成功投资者的策略,用户可以采用有效的技术和分配模型,改进他们的投资方法。这种持续的学习过程不仅可以提高他们对合理投资实践的理解,还可以培养一种知情决策的文化。最终,MAXE 为日常投资者提供了必要的工具,使他们能够更自信、更清晰地应对金融市场的复杂性,使他们成为投资领域更熟练的参与者。

MAXE 为全球用户提供服务,迄今为止该应用程序的下载量已超过 30 万次。这一里程碑表明,随着越来越多的个人使用该应用程序来增强其投资和财务管理策略,MAXE 的价值得到了越来越多的认可。

MAXE 现已在 Google Play 和 应用商店! 告别传统财务管理方式,与 MAXE 一起迈向财务的未来。如需更多信息,请访问我们的网站 www.maxeai.com 并在社交媒体上关注我们,了解最新的财务管理动态和技巧。